Adani Response

ADANI RESPONSE January 29, 2023 1

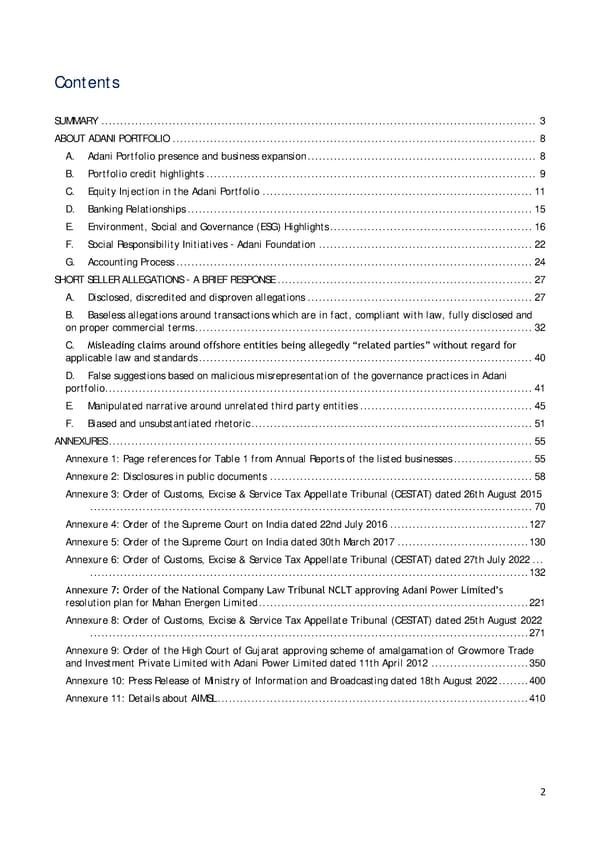

Contents SUMMARY .................................................................................................................... 3 ABOUT ADANI PORTFOLIO ................................................................................................. 8 A. Adani Portfolio presence and business expansion ............................................................. 8 B. Portfolio credit highlights ........................................................................................ 9 C. Equity Injection in the Adani Portfolio ........................................................................ 11 D. Banking Relationships ............................................................................................ 15 E. Environment, Social and Governance (ESG) Highlights ...................................................... 16 F. Social Responsibility Initiatives – Adani Foundation ......................................................... 22 G. Accounting Process ............................................................................................... 24 SHORT SELLER ALLEGATIONS – A BRIEF RESPONSE .................................................................... 27 A. Disclosed, discredited and disproven allegations ............................................................ 27 B. Baseless allegations around transactions which are in fact, compliant with law, fully disclosed and on proper commercial terms .......................................................................................... 32 C. Misleading claims around offshore entities being allegedly “related parties” without regard for applicable law and standards ......................................................................................... 40 D. False suggestions based on malicious misrepresentation of the governance practices in Adani portfolio .................................................................................................................. 41 E. Manipulated narrative around unrelated third party entities .............................................. 45 F. Biased and unsubstantiated rhetoric ........................................................................... 51 ANNEXURES ................................................................................................................. 55 Annexure 1: Page references for Table 1 from Annual Reports of the listed businesses ..................... 55 Annexure 2: Disclosures in public documents ...................................................................... 58 Annexure 3: Order of Customs, Excise & Service Tax Appellate Tribunal (CESTAT) dated 26th August 2015 ...................................................................................................................... 70 Annexure 4: Order of the Supreme Court on India dated 22nd July 2016 ..................................... 127 Annexure 5: Order of the Supreme Court on India dated 30th March 2017 ................................... 130 Annexure 6: Order of Customs, Excise & Service Tax Appellate Tribunal (CESTAT) dated 27th July 2022 ... ..................................................................................................................... 132 Annexure 7: Order of the National Company Law Tribunal NCLT approving Adani Power Limited’s resolution plan for Mahan Energen Limited ........................................................................ 221 Annexure 8: Order of Customs, Excise & Service Tax Appellate Tribunal (CESTAT) dated 25th August 2022 ..................................................................................................................... 271 Annexure 9: Order of the High Court of Gujarat approving scheme of amalgamation of Growmore Trade and Investment Private Limited with Adani Power Limited dated 11th April 2012 .......................... 350 Annexure 10: Press Release of Ministry of Information and Broadcasting dated 18th August 2022 ........ 400 Annexure 11: Details about AIMSL ................................................................................... 410 2

SUMMARY I. A NOTE OF CAUTION TO OUR STAKEHOLDERS We are shocked and deeply disturbed to read the report published by the “Madoffs of Manhattan” - Hindenburg Research on 24 January 2023 which is nothing but a lie. The document is a malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive. This is rife with conflict of interest and intended only to create a false market in securities to enable Hindenburg, an admitted short seller, to book massive financial gain through wrongful means at the cost of countless investors. It is tremendously concerning that the statements of an entity sitting thousands of miles away, with no credibility or ethics has caused serious and unprecedented adverse impact on our investors. The mala fide intention underlying the report is apparent given its timing when Adani Enterprises Limited is undertaking what would be the largest ever further public offering of equity shares in India. This is not merely an unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India. While we are under no obligation whatsoever to respond to these baseless allegations made in the report, in the spirit of good governance, transparency to our stakeholders and to avoid false market, we provide our responses to the Report as also the “88 questions” raised in the report. There are three key themes from the Hindenburg Report: (i) Selective and manipulative presentation of matters already in the public domain to create a false narrative. (ii) Complete ignorance or deliberate disregard of the applicable legal and accounting standards as well as industry practice. (iii) Contempt for the Indian institutions including the regulators and the judiciary. II. UNVEILING HINDENBURG’S MOTIVES The report has been put out with the admitted intent of Hindenburg (holding short positions in various listed companies of the Adani portfolio through U.S. traded bonds and non-Indian-traded derivatives, along with other non-Indian-traded reference securities) to profiteer at the cost of our shareholders and public investors. Hindenburg has not published this report for any altruistic reasons but purely out of selfish motives and in flagrant breach of applicable securities and foreign exchange laws. 3

The truth of the matter is that Hindenburg is an unethical short seller. A short seller in the securities market books gain from the subsequent reduction in prices of shares. Hindenburg took “short positions” and then, to effect a downward spiral of share price and make a wrongful gain, Hindenburg published a document to manipulate and depress the price of stock, and create a false market. The allegations and insinuations, which were presented as fact, spread like fire, wiping off a large amount of investor wealth and netting a profit for Hindenburg. The net result is that public investors lose and Hindenburg makes a windfall gain. Thus, the report is neither “independent” nor “objective” nor “well researched”. The report claims to have undertaken a “2-year investigation” and “uncover evidence”, but comprises of nothing other than selective and incomplete extracts of disclosed information which has been in the public domain for years if not decades, attempts to highlight allegations which have since been judicially determined to be false, narrates as fact what is attributed to hearsay, rumours and gossip spread by unnamed sources such as “a former trader” or “touts” of a “close relationship”, questions the independence of the judicial processes and regulators in the nation, and selectively extracts statements devoid of their context and with no understanding of Indian law or industry practice. It is telling that not one of the allegations is a result of any independent or journalistic fact finding. The allegations and innuendoes made in the Hindenburg report are knowingly false. Hindenburg’s conduct is nothing short of a calculated securities fraud under applicable law. III. THE SHOE IS ON THE OTHER FOOT – HINDENBURG’S ACTIVE CONCEALMENT Ironically for an organization that seeks transparency and openness, nothing much is known about either Hindenburg or its employees or its investors. Its website alleges that the organisation has an experience that “spans decades” and yet appears to have been set up only in 2017. Despite all its talks of “transparency”, Hindenburg has actively concealed the details of its short positions, the source of its own funding, who is behind them, the illegality underlying the synthetic structures by which they hold such positions, or the profit it has made by holding such positions in our securities. IV. OUR RESPONSE TO THE ALLEGATIONS Not one of these 88 questions is based on independent or journalistic fact finding. They are simply selective regurgitations of public disclosures or rhetorical innuendos colouring rumours as fact. The report seeks answers to “88 questions” – 65 of these relate to matters that have been duly disclosed by Adani Portfolio companies in their annual reports available on their websites, offering memorandums, financial statements and stock exchange disclosures from time to time. Of the balance 23 questions, 18 relate to public shareholders and third parties (and not the Adani portfolio companies), while the balance 5 are baseless allegations based on imaginary fact patterns. Nonetheless, we have responded to all these questions, summarized below: 4

1. Disclosed, discredited and disproven allegations: Allegations no. 1, 2, 3, 27, 28, 29, 30, 31, 72, 73, 74, 75, 76, 77, 78, 79, 80 present no new findings and only dredge up allegations (in some cases from a decade ago) which have been judicially determined in our favour and have also been disclosed by us to our investors and the regulators. By way of an example, there are multiple false narratives being created in relation to certain allegations concerning diamond exports, which matters have all been closed by the Appellate Tribunal (CESTAT) in our favour. This decision has been further confirmed by the Supreme Court itself twice over, a fact which has been deliberately ignored and concealed in the Hindenburg report (which contemptuously raises questions on the competence of the Appellate Tribunal with baseless claims that it has ignored evidence). 2. Baseless allegations around transactions which are in fact, compliant with law, fully disclosed and on proper commercial terms: Allegation no. 9, 15, 19, 24, 25, 32, 33, 35, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, 51, 53, 54, 55, 56, 57, 58, 59, 60, 61, 81, 82 & 83 are again a selective regurgitation of disclosures from the financial statements of Adani entities to paint a biased picture. These disclosures have already been approved by third parties who are qualified and competent to review these (rather than an unknown overseas shortseller) and are in line with applicable accounting standards and applicable law. In another instance (allegation 41 of the Hindenburg Report), they have falsely claimed that Emerging Market Investment DMCC gave a loan of USD 1 billion to Mahan Energen. The simple fact of the matter is that Emerging Market acquired the USD 1 billion “unsustainable debt” of Mahan Energen from its lenders for USD 100 as part of a resolution plant duly approved by the National Company Law Tribunal under the Indian Bankruptcy Code. These are mala fide attempts to question bona fide transactions, the details of which are fully disclosed and available in the public domain, to create doubt in the minds of our stakeholders and the public. In fact, the mala fide intent of Hindenburg can be clearly seen from it suggesting structures that would not be in compliance with corporate governance. By way of example, a fully disclosed transaction (see allegation 61 of the Hindenburg Report) of Adani Enterprises Limited’s subsidiary with NQXT to pay a standard security deposit (a common feature under long term take or pay contracts) for use of terminals has been questioned. Hindenburg seems to suggest that NQXT (a corporate entity in its own right and subject to its own regulations) should provide Adani Enterprises long term terminals for no charges at all – a transaction that would amount to providing a benefit to a related party without arm’s length terms. 3. Misleading claims around offshore entities being allegedly “related parties” without regard for applicable law and standards: Allegation no. 4, 36, 37, 38, and 39 from the report are in reference to offshore entities. The queries make reckless statements without any evidence whatsoever and purely on unsubstantiated speculations without any understanding of the Indian laws around related parties and related party transactions. 5

4. False suggestions based on malicious misrepresentation of the governance practices in Adani portfolio : Allegation no. 34, 62, 63, 64, 65, 66, 67, 68, 69, 70, and 71 use selective information to make insinuations, when in fact, the Adani portfolio has instituted various corporate governance policies and committees including our Corporate Responsibility Committee consisting solely of independent directors tasked with keeping the Board of Directors informed about the ESG performance of businesses. Our ESG approach is based on well-thought out goals, commitments and targets which are independently verified through an assurance process. An example of where the report exposes its motives is the question around “convoluted structures” and multiplicity of subsidiaries, while failing to comprehend that in the infrastructure business, especially in a sprawling geography like India, most large corporates operate in a similar fashion because projects are housed in separate SPVs and these need to be ring fenced from a lender perspective for limited recourse project finance and in many cases on account of specific regulatory requirements. As an example, transmission projects in India are awarded under tariff based competitive bidding, in such bidding the successful bidder has to acquire the SPV which is undertaking the project. Hence, it is a regulatory requirement as part of the Electricity Act, 2003 and the regulations of the Central Electricity Regulatory Commission to execute projects in different SPVs 5. Manipulated narrative around unrelated third party entities: Allegation no. 5, 6, 7, 8, 10, 11, 12, 13, 14, 16, 17, 18, 20, 21, 22, 23, 26 and 52 from the report seek information on our public shareholders. Shares of listed companies on Indian stock exchanges are traded on a regular basis. The listed entity does not have control over who buys / sells / owns the publicly traded shares in the company. A listed company does not have nor is it required to have information on its public shareholders and investors. Hindenburg deliberately ignores Indian legal processes and regulations in their insinuations against us. For instance, they have raised several questions around the offer for sale undertaken by Adani Green Energy Limited in 2019 while maliciously ignoring the fact that in India the process for OFS is a regulated process implemented through an automated order book matching process on the platform of the stock exchange. This is not a process which is controlled by any entity and the purchasers are not visible to anyone of the platform. 6. Biased and unsubstantiated rhetoric: Allegation no. 84, 85, 86, 87, and 88 from the report are inherently biased statements around our openness to address criticism with a window- dressing to garb them as questions. Criticism does not include the right to make false and defamatory statement which could damage the interests of our stakeholders. We continue to have the right to seek judicial remedy before Indian courts when such interests are threatened, and in all cases, we have exercised these rights in due compliance with law and the judicial process. Hindenburg has sought to spotlight selective media reporting while deliberately ignoring judicial findings. For instance, in another twisting of facts, Hindenburg questions why we sought to have a “critical journalist” jailed. The fact of the matter is that he was never jailed in connection with any proceedings related to us and in fact, a non-bailable warrant had been 6

issued to him by the judge because he failed to appear before the court despite summons and was not complying with the judicial process. V. OUR COMMITMENT TO HIGHEST LEVELS OF COMPLIANCE AND CONTINUED GROWTH We reaffirm that we are in compliance with all applicable laws and regulations. We are committed to the highest levels of governance to protect the interests of all our stakeholders. The Adani Portfolio also has very strong internal controls and audit controls. All the listed companies of Adani Portfolio have a robust governance framework. The Audit Committee of each of the listed companies is composed of 100% of Independent Directors and chaired by Independent Director. The Statutory Auditors are appointed only upon recommendation by the Audit Committee to the Board of Directors. Adani Portfolio company’s follow a stated policy of having global big 6 or regional leaders as Statutory Auditors. The focus of the Adani portfolio and the Adani verticals is to contribute to nation building and take India to the world. We will exercise our rights to pursue remedies to safeguard our stakeholders before all appropriate authorities and we reserve our rights to respond further to any of the allegations or contents of the Hindenburg report or to supplement this statement. 7

ABOUT ADANI PORTFOLIO Prior to responding on the specific queries raised in the report, we would like to highlight certain points in relation to the Adani Portfolio. A. Adani Portfolio presence and business expansion Adani Portfolio operates in four broad verticals − The first two verticals are Energy and Utility Vertical, Transport and Logistics vertical, which together form the infrastructure sector businesses of Adani portfolio. The businesses are fully integrated in their respective sectors and present across the entire value chain. − The third vertical is Primary Industries vertical, which feeds off the strengths of the portfolio across Energy and utility vertical and transport and logistics vertical. For example, the Cement manufacturing business has significant adjacencies to power, energy, resource and logistics businesses of the portfolio. − The fourth vertical is direct to consumer (Emerging B2C), which includes consumer businesses such as Adani Digital Labs and Adani Wilmar Limited. It may be further noted that all businesses which require shareholder support are housed under the incubator arm – Adani Enterprises Limited (AEL). These businesses continue under AEL till the time the business is self-sustaining post which they are listed separately creating value for AEL’s shareholders. Further, all the listed businesses operate on a strict “no financial accommodation” policy and have independent boards and management. The businesses operate on a simple yet robust and repeatable business model focused on development and origination, operations and management and capital management plan. 8

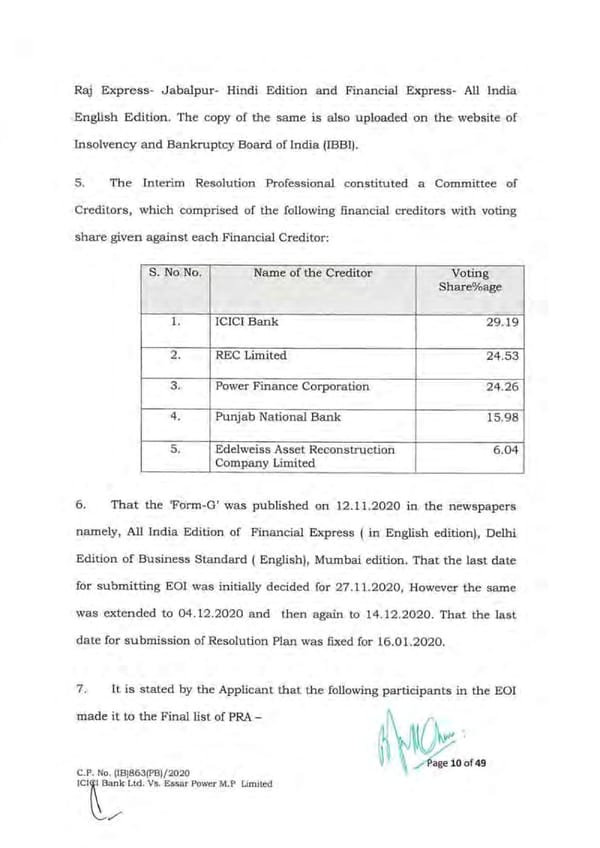

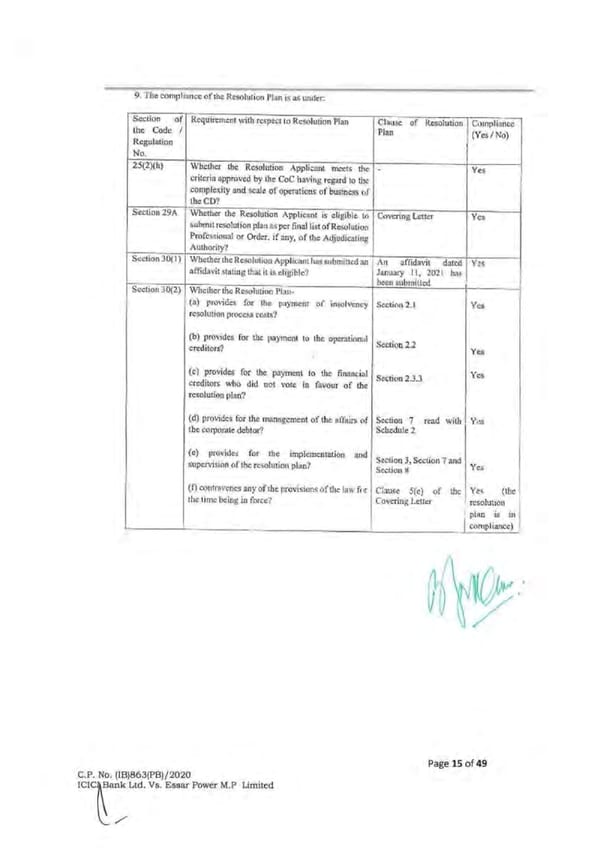

B. Portfolio credit highlights Adani Portfolio companies have successfully and repeatedly executed an industry beating expansion plan over the past decade. While doing so, the companies have consistently de-levered with portfolio net debt to EBITDA ratio coming down from 7.6x to 3.2x (Please see Chart A below), EBITDA has grown 22% CAGR in the last 9 years and debt has only grown by 11% CAGR during the same period. Please see below a table summarizing key financial metrics and ratios for Adani portfolio companies – Table 1: Key Financial Metrics and Ratios (For the financial year ended 31st Mar 2022) Particulars (INR Bn) AEL AGEL APSEZ APL ATGL ATL Total (1) EBITDA 50.00 39.55 120.99 138.69 8.15 54.93 412 (2) Run Rate EBITDA (RR EBITDA ) 87.13 66.44 130.55 154.75 8.15 60.04 507 Unrestricted Cash 9.12 19.53 95.63 7.80 3.89 22.95 159 Restricted Cash (such as DSRA) 30.04 19.14 33.61 20.09 - 7.72 111 Total Cash for Netting off 39.16 38.67 129.24 27.89 3.89 30.67 270 Gross Debt(3) 284.83 443.90 456.37 414.18 9.95 274.91 1,884 Net Debt(4) 245.67 405.23 327.13 386.29 6.06 244.24 1,615 Gross Leverage (Gross Debt / EBITDA) 5.70x 11.22x 3.77x 2.99x 1.22x 5.01x 4.57x Gross Debt / RR EBITDA 3.27x 6.68x 3.50x 2.68x 1.22x 4.58x 3.72x 9

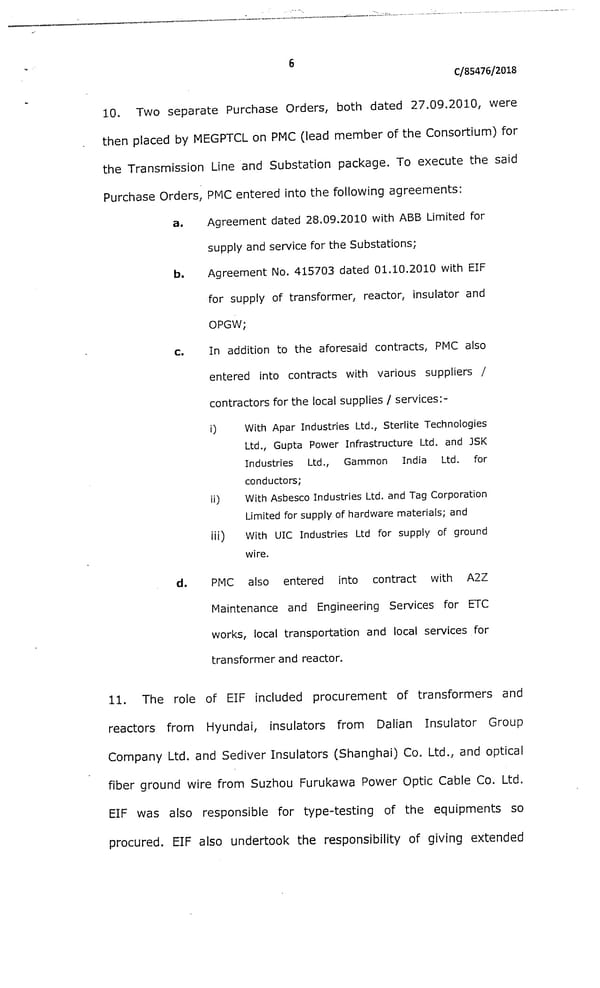

Particulars (INR Bn) AEL AGEL APSEZ APL ATGL ATL Total Net Leverage (Net Debt / EBITDA) 4.91x 10.25x 2.70x 2.79x 0.74x 4.45x 3.92x Net Debt / RR EBITDA 2.82x 6.10x 2.51x 2.50x 0.74x 4.07x 3.18x (5) EBITDA / Gross Interest 1.98x 1.51x 4.73x 3.39x 15.37x 2.32x 2.90x Note: AEL: Adani Enterprises Limited, AGEL: Adani Green Energy Limited, APSEZ: Adani Ports and Special Economic Zone Limited, APL: Adani Power Limited, ATGL: Adani Total Gas Limited, ATL: Adani Transmission Limited Please refer Annexure 1 for references to above numbers from annual reports of respective companies 1. EBITDA: Earnings before interest, taxes, depreciation and amortization. EBITDA includes other income and is as per numbers reported in audit financials 2. RR EBITDA: Run-rate EBITDA considers annualized EBITDA for assets commissioned after the start of the year. Run rate EBITDA includes other income. AEL Run-rate EBITDA includes annualized EBITDA for Road and Mining Assets which has been operational for partial Period. It also includes the ramp-up based EBITDA of Airport Assets. AGEL Run-rate EBITDA includes the annualized EBITDA for the Assets which has been operational for partial period and also the assets which have been commissioned but not achieved the COD as per PPA. APSEZ Run-rate EBITDA includes the Annual EBITDA of Gangavaram Port which will be consolidated fully post NCLT approval from 1st April 2021 onwards. APL Run-rate EBITDA includes the Annual EBITDA of Mahan Energen and Merchant Revenue being annualized basis market of Q4FY22 3. Gross debt includes term debt and working capital debt and excludes shareholder subordinated debt 4. Net debt = Gross debt less (Cash and cash equivalents). Both restricted and unrestricted cash and cash equivalents are considered 5. Gross interest includes interest corresponding to Gross debt Kindly note that the annotated backup of all the numbers is as attached in Annexure 1 of this document. Chart A: EBITDA growth is 2X the growth of debt over last 5 years Net Debt / RR EBIDTA 7.6x 4.0x 3.2x 2013 2016 2022 The leverage ratios of Adani Portfolio companies continue to be healthy and are in line with the industry benchmarks of the respective sectors. Over the last 10 years we have actively worked to improve our debt-metrics through our capital management strategy. Please refer Chart B below for diversification of our long-term debt profile through our capital management strategy. 10

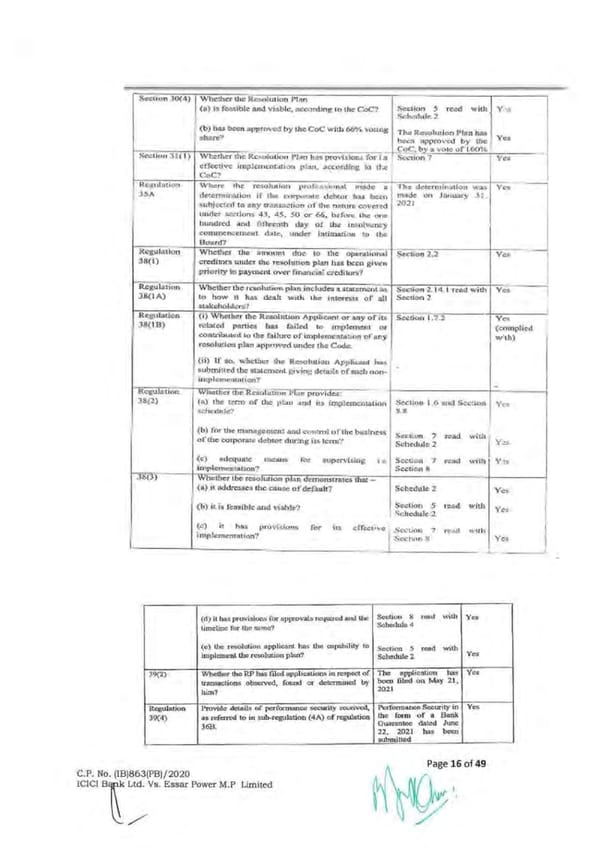

Chart B: Diversifying long term debt profile towards higher share of bonds March 2016 55 31 14 March 2022 25 8 37 6 18 6 PSU Private Banks Bonds DII Global Intl. Banks PSU - Capex LC The Adani portfolio companies have a full-fledged Capital Management Plan (CMP) which has all credit metrics inbuild. The CMP of companies are set in a manner to automatically pushing it for deleveraging path. C. Equity Injection in the Adani Portfolio Adani Portfolio has raised USD 16 bn equity under a systematic capital management plan for all the Portfolio companies over the last 3 years as a combination of primary, secondary and committed equity from marquee investors like TotalEnergies, IHC, QIA, Warburg Pincus etc. The overview of our partnership model is as presented below. 11

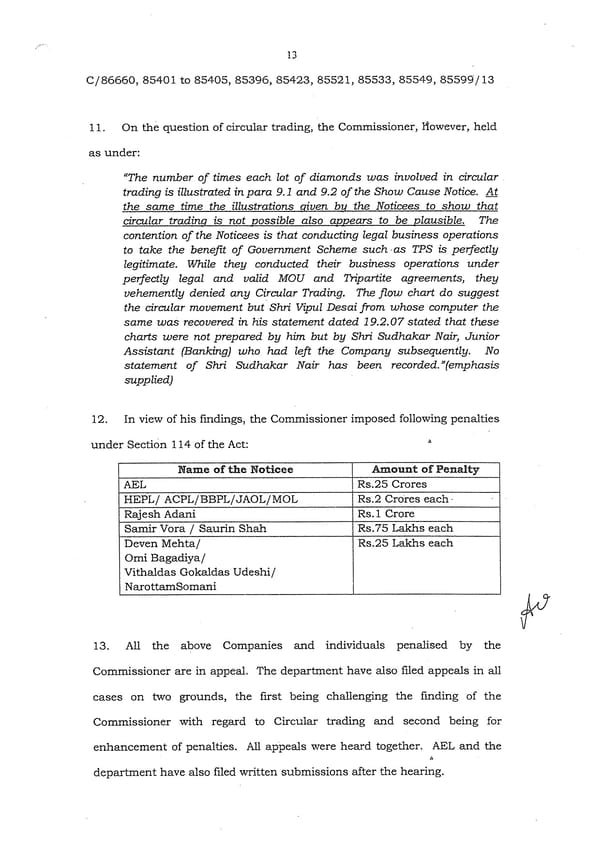

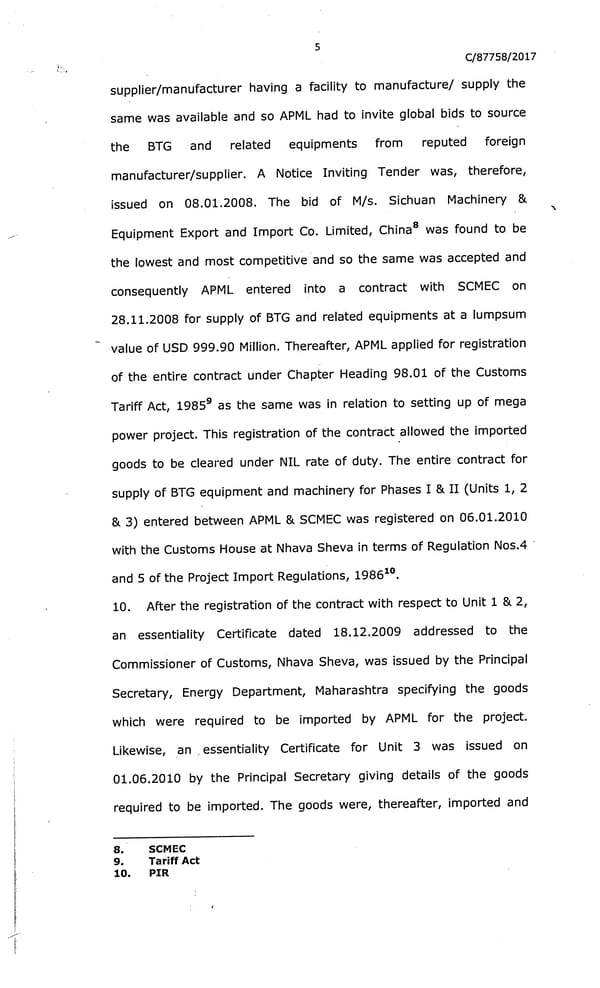

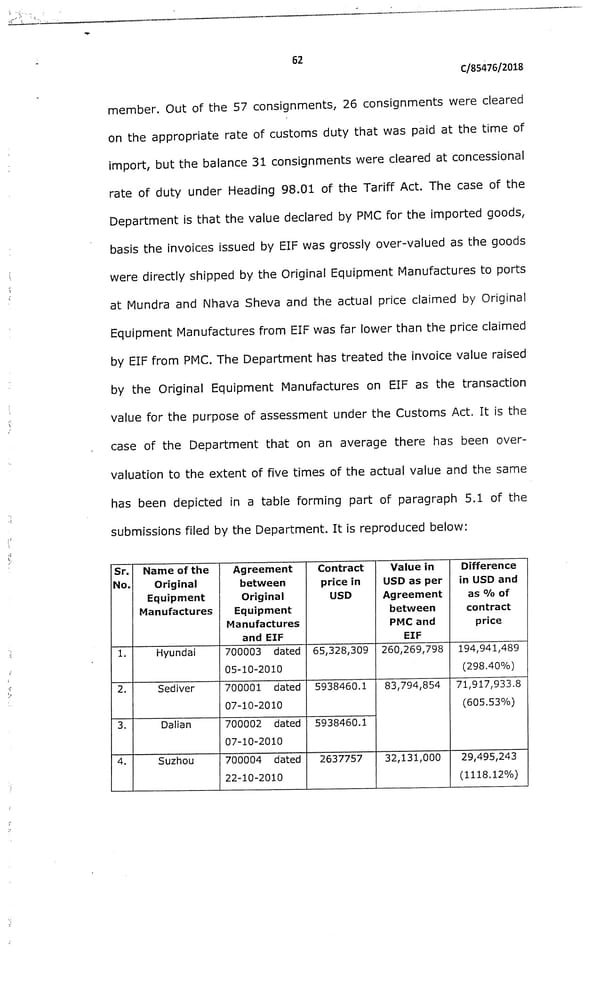

This has also resulted in the deleveraging of the Promoter level debt, allowing the reduction in the promoter stake pledge in the listed companies (Please refer Chart C below). Chart C: Promoter Gross Pledge position The equity contribution includes the platform level investments made by IHC across 3 of its portfolio 1 companies AEL (USD 1 bn ), AGEL (USD 500 mn) and ATL (USD 500 mn) totaling to USD 2 bn which was settled in May 2022. 1. Approx INR 77 bn 12

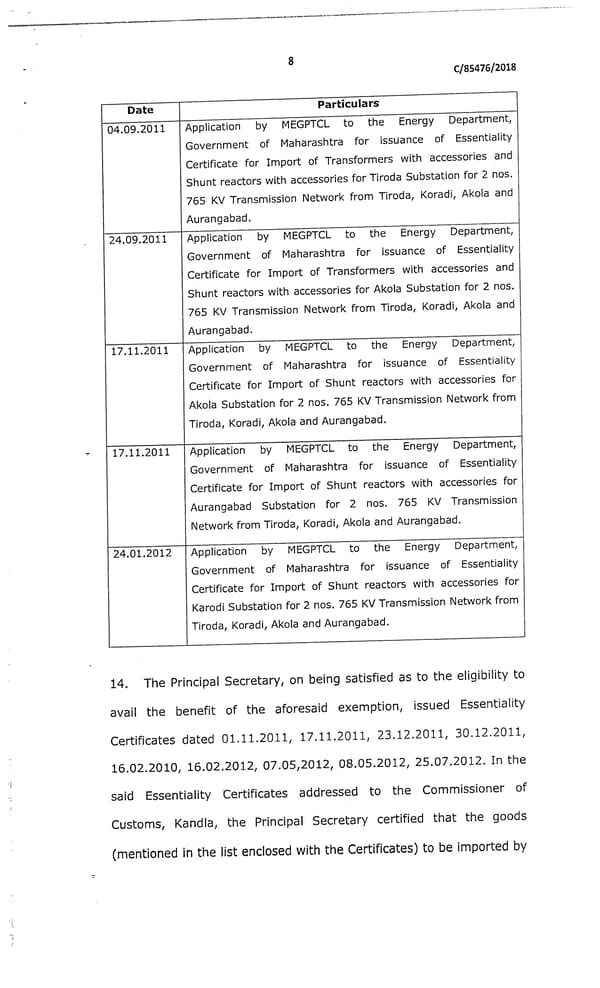

TotalEnergies, one of the leading integrated energy players globally, has strategic alliance with the Adani portfolio across its four verticals, namely LNG Terminal (Adani Total Private Limited), City Gas Distribution (Adani Total Gas Limited), Renewable Power Generation (Adani Green Energy Limited) and Green Hydrogen ecosystem (Adani New Industries Limited) with committed investments of USD 7.3 bn over past 3 years. Adani has also successfully concluded the IPO of portfolio FMCG company AWL (Adani Wilmar Limited) amounting to INR 36 bn (USD 450 mn) during the month of February 2022. 13

Adani portfolio companies have a strong track record of delivering value to shareholders attracting equity investors. For example, INR 150 invested in Adani Enterprises Limited, which was the first IPO (in 1994) out of the Adani portfolio, has generated a market valuation of INR 9,00,000 in the past 28 years that is a 6,000x multiple. Over the past three years, the Adani portfolio has raised USD 32.3bn capital, which is split into USD 8.3bn in DCM issuances, USD 8bn in Go To market facilities and USD 16bn in Equity Capital program, which is the largest program by any group in India We also refer to a paragraph in the report that “there may be additional, hidden leverage within the Adani empire in the form of pledges on the undisclosed shareholdings described in Part 1” It may be noted that any encumbrance creation needs to be created through depository participant of respective shareholder. As part of the regulated reporting process, the depository participant reports this to the depository (National Securities Depository Limited / Central Depository Services Limited). The corresponding information automatically gets captured within stock exchange database as well. The above process needs to be followed to ensure that the encumbrance is valid, registered and enforceable. Stock exchanges disclose encumbrance created on both promoter held and public held shares as compiled in the above table. Therefore, there is no possibility of any additional, hidden leverage as referenced in the report. Below is breakup of the equity share pledge for Adani listed companies as on December 31, 2022, which is also available publicly on the exchange websites on a quarterly basis. Company % Shares publicly held % Promoter Shares % Public Shares by Promoter Group encumbered encumbered AGEL 60.75% 4.36% -% APL 74.97% 25.01% -% ATGL 74.80% -% -% 14

Company % Shares publicly held % Promoter Shares % Public Shares by Promoter Group encumbered encumbered ATL 74.19% 6.62% -% AEL 72.63% 2.66% -% APSEZ 65.13% 17.31% -% AWL 87.94% -% -% Source: Bombay stock exchange (BSE), National stock exchange (NSE) Note: AEL: Adani Enterprises Limited, AGEL: Adani Green Energy Limited, APSEZ: Adani Ports and Special Economic Zone Limited, APL: Adani Power Limited, ATGL: Adani Total Gas Limited, ATL: Adani Transmission Limited, ACL: Ambuja Cements Limited, ACCL: ACC Limited; AWL: Adani Wilmar Limited D. Banking Relationships The portfolio has developed deep domestic and international bank relationships, which is outlined below. This has strengthened access to diverse funding sources and structures. Further, Adani Portfolio companies have demonstrated successful syndication of the banking transactions, resulting in de-risking of the banks in volatile markets. Case in point being Holcim’s Indian cement business acquisition with international banks, and Navi Mumbai Airport and Kutch Copper refinery with domestic banks. 15

It may be noted that Adani Portfolio has issued 30Yr bonds (USPP – Adani Transmission Portfolio), 20 Yr Bonds (APSEZ 2041) and 20 Yr Amortiser Bonds (AGEL, RG2), which outlines deep access to international bond markets and infrastructure investors. E. Environment, Social and Governance (ESG) Highlights Adani Portfolio companies are fully committed to ESG aspects and have a robust ESG framework and glide path in place, which is focused on assurance framework. 16

We have identified key ESG risks and adopted multiple mitigation measures which are business specific for e.g. Mangrove Afforestation in Adani Ports and Increasing Renewable mix in power procurement from 3% in FY21 to 30% FY23 and 60% by FY27 in Adani Electricity Mumbai, part of Adani Transmission Limited. The Adani portfolio companies have adopted best-in-class global disclosures and standards like TCFD, SBTi, CDP, SDGs. The portfolio companies are on track to achieve the following: − Water neutrality − Zero Waste to Landfill − Single use plastic free sites − Mangrove Afforestation − Zero Biodiversity Net Loss − Carbon Neutrality Additionally, we have improved our Governance standards to align it with Global Best practices. We have already constituted a Corporate Responsibility Committee (consisting of 100% independent directors) in all of our portfolio companies which does the review of the ESG progress and framework alignment with progress of the same. Most of the Board Committees in the portfolio companies have majority representation from independent directors. All committee’s Terms of References (TOR) has to be reviewed by the board on periodic basis. Below is a short summary of the ESG credentials and environmental commitments of Adani Portfolio companies: 17

Key Environmental commitments of Adani Portfolio companies Note: TCFD: Task Force on Climate-Related Financial Disclosures, SBTi: Science Based Targets initiative, UNGC: United Nations Global Compact, DJSI: Dow Jones Sustainability Indices Governance At the heart of the Adani governance commitment is a one tier Board system with Board of Directors possessing a disciplined orientation and distinctive priorities. Our robust governance structure is based on well-structured policies and procedures that are the backbone of our governance philosophy. Our policies are formulated to ensure business continuity and to maintain a high quality throughout our operations. Board of Directors are the highest authority for the governance and the custodian who push our businesses in the right direction. They provide the overall strategic insights and guidance to our business operations. Our governance framework reflects our value system and is built to boost our governance mechanisms. Ethics and integrity: The Boards of the Adani portfolio (“Boards”) are committed to the highest integrity standards. Directors commit to abide by the ‘Code of Conduct’, regulations and policies under oath, endeavouring to demonstrate intent and actions consistent with stated values. Responsible conduct: The Boards emphasize the Adani portfolio’s role in contributing to neighbourhoods, terrains, communities and societies. In line with this, the Adani portfolio is accountable for its environment and societal impact, corresponded by compliance with laws and regulations. As a mark of responsibility, the Adani businesses extend beyond minimum requirements with the objective of emerging as a responsible corporate. Accountability and transparency: The Boards engage in comprehensive financial and nonfinancial reporting, aligned to best practices relating to disclosures; it follows internal and/or external assurance and governance procedures Structure of the board: All Adani portfolio entities’ Board represents an appropriate balance between executive, non-executive and independent directors to safeguard the interests of 18

stakeholders, including shareholders. The Board comprises of at least 50% Independent Directors and the businesses are headed by professional CEOs/ Executive directors. To ensure the effectiveness of corporate governance and that all our operations are well-governed, the Board has established sub-committees that supervise various business functions. This enables the Board to remain updated on all developments in the Company, as the Committees provide in- depth scrutiny over all business aspects. All Committees conduct meetings with defined periodicity to ensure the smooth functions of the business functions they are responsible for. Committees to the Board have at least 50% members as Independent Directors. Following is the summary of the Committees: Name of the Committee Composition Meeting Frequency Audit Committee 100% Independent Directors Quarterly Nomination and Remuneration 75% Independent Directors At least twice in a Committee year Stakeholders’ Relationship Committee 50% Independent Directors Quarterly Corporate Social Responsibility 75% Independent Directors Half Yearly Committee Risk Management Committee 50% Independent Directors Quarterly Corporate Responsibility Committee 100% Independent Directors Quarterly Information Technology & Data >50% Independent Directors Half Yearly Security Committee (Sub-Committee to Risk Management Committee) Mergers & Acquisitions Committee >50% Independent Directors As and when (Sub-Committee to Risk Management applicable Committee) Legal, Regulatory & Tax Committee 100% Independent Directors Half Yearly (Sub-Committee to Risk Management Committee) Reputation Risk Committee (Sub- >50% Independent Directors Half Yearly Committee to Risk Management Committee) Detailed charters for the committees are available on the website of each of the Adani portfolio listed entities. Board diversity: Our Boards diversity harnesses differences in knowledge, skills, regional exposure, industry experience, cultural backgrounds, ages, ethnicity, races and gender. Adani businesses developed a Board Diversity Policy, which is available on their respective websites. Skills and experience: The Boards aggregate knowledge, perspective, professionalism, differentiated mindsets and experience. The Board members possess a rich understanding of different sectors, strategy, governance, risks, legal, technical, environmental, social, financial, 19

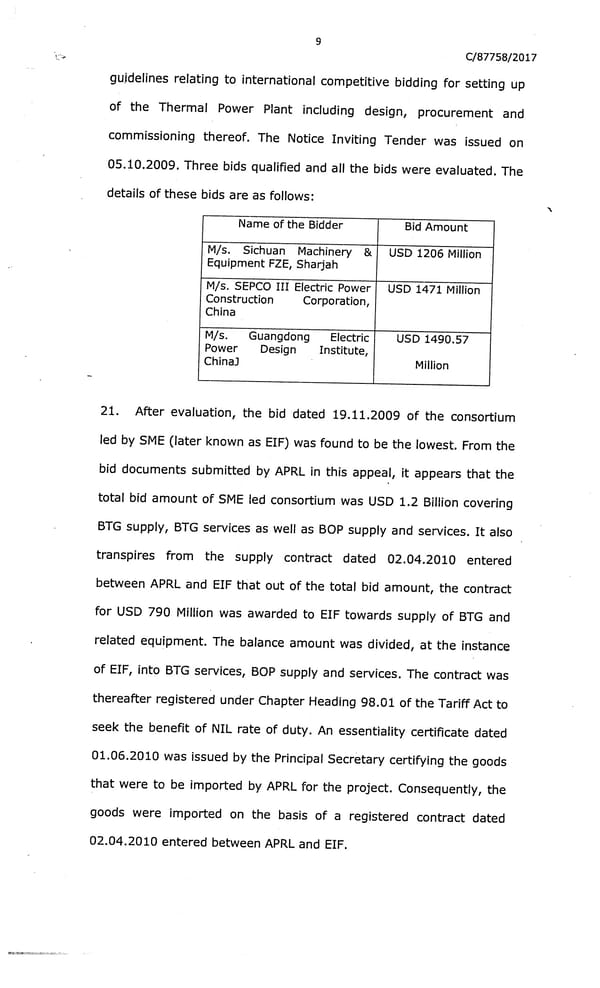

non-financial, risks, legal, different sectors, strategy, governance, risks, legal, technical, environmental, social, financial, non-financial, risks, legal and environment matters. The Board members are periodically upskilled on emerging risks and trends, including ESG related risks and opportunities. Board member credentials The Board members are identified and selected based on their skillsets, capabilities, business requirement including compliance with the following: • Embrace the shared organisational vision, mission and values • Knowledge of the industrial/ sectors, policies, major risks and potential opportunities in which the relevant Adani portfolio operates • Technical skills/experience in accounting/finance, governance or public policy, economy, human resource management, strategy development and implementation of capital planning • Governance attributes such as compliance, leadership, risk management experience and a sound business judgment • Unqualified independence, in case of independent directors • Willingness to act in the best interest of stakeholders Based on above criteria, the Nomination and Remuneration Committee (NRC) recommends the candidature of Board members to the respective Board, for its approval, subject to the consent of shareholders, within the defined timelines, as prescribed under the applicable laws. The selection for second term is based on formal evaluation and recommended of NRC. Board evaluation and compensation The Boards are evaluated through a formal mechanism which comprises an evaluation of individual Board Members, committees, Chairperson(s) and the Board as a whole. The exercise is carried out through a structured process, covering the Board and committee composition as well as comprehensive functioning, experience and competencies, performance of specific duties and obligations, contribution at meetings and otherwise, independent judgment and governance issues, among others. The breadth of fiduciary responsibility of the Board critically attaches the Board evaluation mechanism to the overall performance. With respect to evaluating effectiveness of the Board, Adani portfolio listed entities are engaging independent third parties for this annual evaluation. The Board compensation is guided by the Remuneration Policy of Directors and is in accordance with law. The Independent Directors are provided fixed sitting fees, commission and the reimbursement of travel expenses. The Independent Directors are not entitled for any stock options. 20

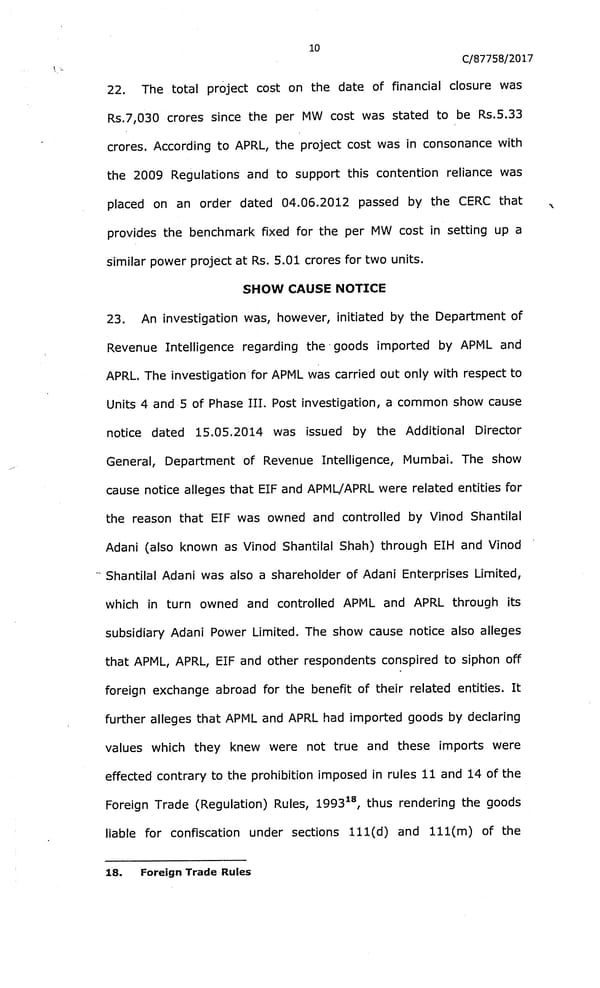

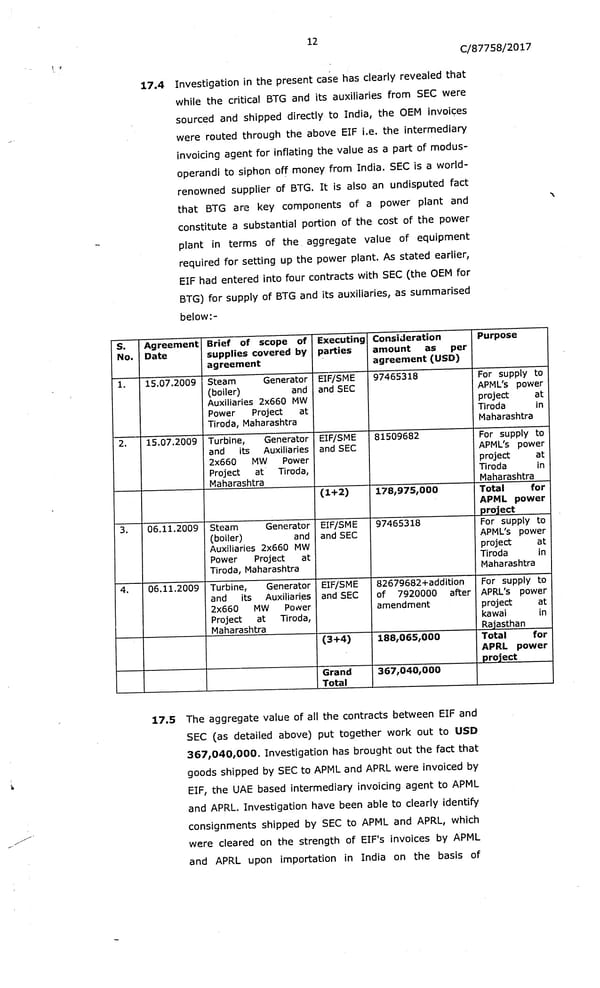

Policies to ensure Transparency and Accountability The Adani Portfolio listed entities have adopted the following governance policies to enhance transparency and accountability across the organisation: 1) Related party transaction policy 2) Whistle-blower Policy 3) Code of conduct for each of the employees (with specific attention to for anti-corruption. Fraud reporting and bribery) 4) Code of conduct for the Board of Directors and senior management personnel 5) Code of ethics 6) Material events policy 7) Policy on Preservation of documents 8) Dividend Distribution policy 9) Anti-Corruption and Anti-Bribery policy 10) Cyber security & Data privacy Policy 11) Remuneration Policy 12) Policy on preservation of Unpublished Price Sensitive Information 13) Policy on preservation of documents 14) Policy on gender equality 15) Employee Grievance management policy 16) Supplier code of conduct 17) Bio Diversity Policy 18) Water Stewardship Policy 19) Human Rights Policy 20) Organisational Health & Safety 21) Prevention of Sexual Harassment 22) ESG / Sustainability Policies Additionally, all Adani portfolio listed entities have published its first Business Responsibility and Sustainability Reporting for FY 2022 on voluntarily basis in order to provide detailed and transparent information to the stakeholders. These reports were also verified by independent third parties. In order to put in place and continually raise the governance standards of Adani portfolio entities and to equip all directors and management with global perspective and ingrain industry best practices, we regularly invite leading sector experts to share their valuable inputs with directors and the management. For example, we have organized sessions with Grant Thornton for financial reporting, with Moody’s for their valuable inputs on ratings and with Latham & Watkins on ESG. 21

F. Social Responsibility Initiatives – Adani Foundation Growth with Goodness is imbibed in the culture of Adani Portfolio. It is about the real impact which we can create, touch the lives, nourish the communities and inspire for future endeavor. Focus is on creating viable livelihood for the people in general, and specifically towards upliftment of women by providing them platform for sustainable growth. Adani Foundation is the delivery partner for various Adani Portfolio companies to deliver the social enterprise. We have created women led social enterprises in the interiors of the country (places like Godda, Bhuj, Mundra, Sarguja, Vizhinjam etc). Our platform is touching, transforming & uplifting 3.7 million lives across more than 2400 village communities in close to 20 States of India. The platform created by Adani portfolio develops and nurtures the Entrepreneurship across various service functions which in turn cascades to various strata of the society. A few case studies of our impact stories is as below Case Study 1 – Vizhinjam – Clean4u – Creating Women Entrepreneurs The Women Entrepreneurs have developed Clean 4 U brand with support from Adani and run it in the most professional way. Not only they provide excellent services to households and offices but employ the local women to get the job done 22

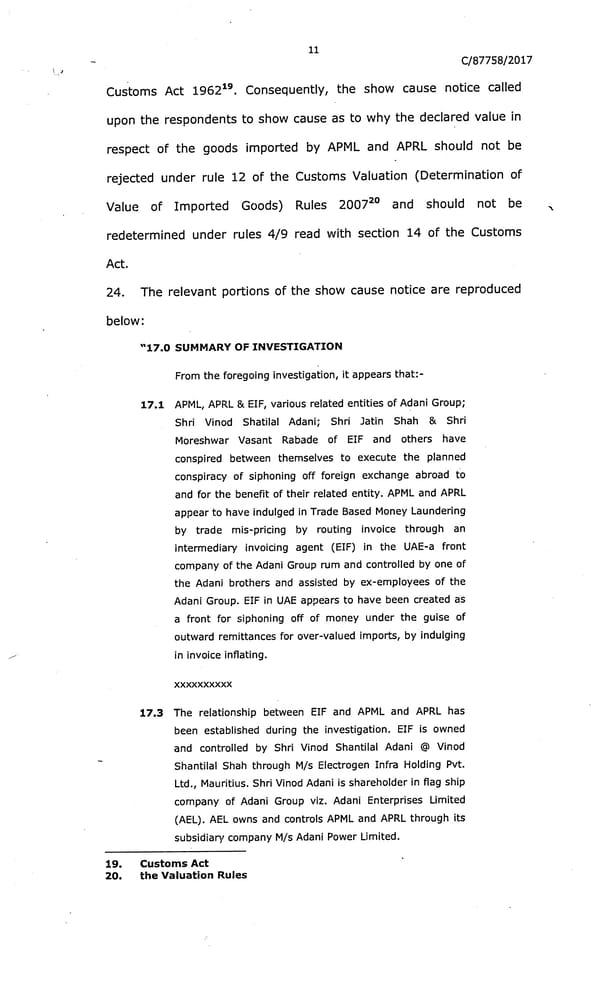

Vi hin am Clean u Creating omen Entrepreneurs Brand Creation Clean u CreatingEmploymentforLocalcommunity Employing 28 women, providing end to end Support of services related to health and hygiene of Adani oundation different sections of society such as schools, hospitals, govtbuildings. THE STORY De elopingleadership Access to human and Empowered28Local Communitywomenof Self funded program financial capital. i hinjamby shaping them into self reliant Hire,train develop workforce. WomenEntrepreneurs Ensuringpropercapital management Facilitate networking Building assets for the Company along with by increasing access to THE IMPACT the growth. local and lobal Improved Standard of Living alleviate markets. Poverty OperationalE cellence: Creatingnetworkfor consumer complaints. Ensuring diversity in Respect in Society Proper channel for correct assessment of hiring activities. Self reliance worktobe executed. uality Education forc hildren Dynamic pricing model based on location, Help in adopting Livelihood earning time,and payingcapacity of consumer. changing technology 17 Case Study 2 – Vizhinjam – Vanitha Krishi Karma Sena – Enabling Women to be self reliant Vanitha rishi arma Sena Vi hin am Enabling omen to be Self Reliant arm Schools Imparting otnh e ob training for Entrepreneurship enabling Self reliance Support of Employing anitha rishi arma Sena with 20 Adani oundation women, Lead by Shashikala (President), Udaya Rani(treasurer)Pr, asanna umari(Secretary) Providingbothservices products: Access to financial THE STORY Ser ice:sTeaching skill set providingtechno capital for building solutions to households for growing farm business Establishmentof rishi armaSena with20 products. It has broughttransformativechanges Local womenof i hinjamby enablingthem in society by moneti ingsurplus land in the Training program to todevelopsubsistentBusinessEnterprise. society. overcome social psychological constraints THE IMPACT roduc:t Availability of Organic vegetables Improved Standard of Living (which are seasonalin nature). Ensuringprice Regular training and Respect in Society paritywithlocal market,maintainingdynamic monitoring for skill Self reliance pricingdependingon demandand supply of the upgradation and enabling uality Education for their children product. women self reliance. Livelihood earning 23

Case Study 3 – SEVAH Local Home grown Brands like SEVAH (Safe to Eat Vegetable for All Homes) focus on running kitchen Garden projects for the community through scientific and Organic farming. SEVAH Vi hin am Safe to eat egetables for households SEVAH ro ect Training for de eloping itchen Gardensto promotebetterhealthand well beingof local Support of communit:y Adani oundation An initiativeto train local people on growing organicvegetableswithinthehouseholds. itchengardensate eryhome: Imparting technical THE STORY Health and well beingof local communityis training, awareness Started with a small initiati e of Training of utmost importance for achieving and knowledge. SEVAH itchen gardens ha e now sustainabledevelopment. reached households at Vi hin am Access to required growing organic egetables and selling itchen garden is an initiative by Adani finance and Input kits them thereby promoting health as well as foundation to promote the well being of and materials. creating employment. people by enabling them to grow organic THE IMPACT vegetablesintheirhouseholdsitself. The Avg production per season 0kgs ero Hunger Distributionof Input kits to households in ood health and well being association with vegetable and fruit Monthly Per Capita ender Equality promotion council. Implemented in 760 Productivity saving s Decent work and Economic growth Households, 2 fishermanhouses. 2. kg. Rs 1, 2 G. Accounting Process Internal Financial control process and governance mechanism is facilitated and monitored by the group based on five key pillars namely a. Centralized ERP Governance Mechanism and Reporting System, b. Periodic internal and external reviews of various processes c. Issuing Corporate guidelines and ensuring their adherence d. Appointment of competent and reputed statutory auditors for all verticals. e. Capacity building programs for facilitating the controls. With these 5 pillars group ensures that highest standards of governance and reporting is being maintained by all businesses across all verticals. Centralized ERP governance mechanism and Reporting system Adani Business Excellence Team (ABEX) is a centralized team which handles accounting and financial controls of all companies across all verticals. All the processes are governed through Standard Operating Practices (SOPs) and the ABEX team ensures that all the financial control parameters are uniformly followed by all the verticals across the group. Also, it is ensured that all group companies follow the stringent financial control governance mechanism established through SAP. There is a well established and properly documented mechanism of maker and checker process established at ABEX. These processes have received various six sigma and ISO awards for maintaining highest degree of compliances and governance. 24

Periodic internal and external reviews of various processes At portfolio level, various processes are being monitored and based on risk assessment different processes are selected for internal or external reviews. In FY22 we have appointed Deloitte and many other auditing firms for doing a health checkup exercise for all business across different verticals. Similarly various processes are being continuously monitored internally to increase our own operating standards. Key book hygiene parameters are also identified which are being monitored every month for all businesses. Issuing Corporate guidelines and ensuring their adherence In order to harmonize different accounting, recognition and disclosure practices followed in various business, the Group Financial & Management Control (GFMC) team issues corporate guidelines to all the verticals. In order to ensure the guidelines are being followed, compliance certificates are taken from CFOs of all the business across various verticals. While issuing the group guidelines its always ensured that disclosure and accounting practices specified in guidelines are far more stringent and requires more disclosures compared the requirement of Ind AS (Indian Accounting Standards), guidance notes, opinions and other reference materials issued by ICAI (The Institute of Chartered Accountants of India). Appointment of competent and reputed statutory auditors for all verticals. All the listed companies of Adani Portfolio have a robust governance framework. The Audit Committee of each of the listed companies is composed of 100% of Independent Directors and chaired by Independent Director. The Statutory Auditors are appointed only upon recommendation by the Audit Committee to the Board of Directors. Adani Portfolio company’s follow a stated policy of having global big 6 or regional leaders as Statutory Auditors. Adani Portfolio also has a policy to conduct an independent review of disclosure and notes by one of the big 6 across all group companies and the last review carried out for FY 20 and FY 21 was undertaken by Grant Thornton. Capacity building programs for facilitating the controls. The group gears up the team across all verticals by including them in training programs imparted by reputed Institutes and prominent subject experts. This is done a part of capability building across all verticals. The team works on set of principles, procedures to make sure that financial statements reflect true and fair view of the state of affairs of all the listed entities. One example of major exercise undertaken in FY 22 across all verticals was preparing a comprehensive risk management (Hedging) policy, which is explained hereunder: Hedging policy: 25

To enhance the risk management and mitigation of various identified risks, during the current financial year (FY23) the group has undertaken detailed exercise of preparing and implementing the hedge policy for different businesses with the help of external expert The group identified different financial risk in the nature of interest rate risk, foreign exchange risk, asset liability maturity mismatches, commodity price risk, credit risk and various other risks for each business. After understanding of different risks in different value chains with plethora of discussion, the group implemented various tools and instruments to mitigate these risks. It is important to note that this exercise ensured that the group is not exposed to any adverse movement in macro-economic parameters. This was very critical considering the fact that group is largest infrastructure group in India and very much vulnerable to any positive or negative movement in domestic and well as foreign macro-economic environment. The group with its competent central treasury team uses different hedging instruments like forwards, options, POS, etc. for mitigating the risk. The risk management policy also ensure that wherever the risk is naturally hedged with business inflows and outflow just like Port business, such matching is properly documented and the same is considered while preparing and deciding for hedging strategy of these businesses. Further, group also continuously looks for opportunities to ensure that its operational excellence and prudent capital allocation is not affected by any negative event in our external economic environment. 26

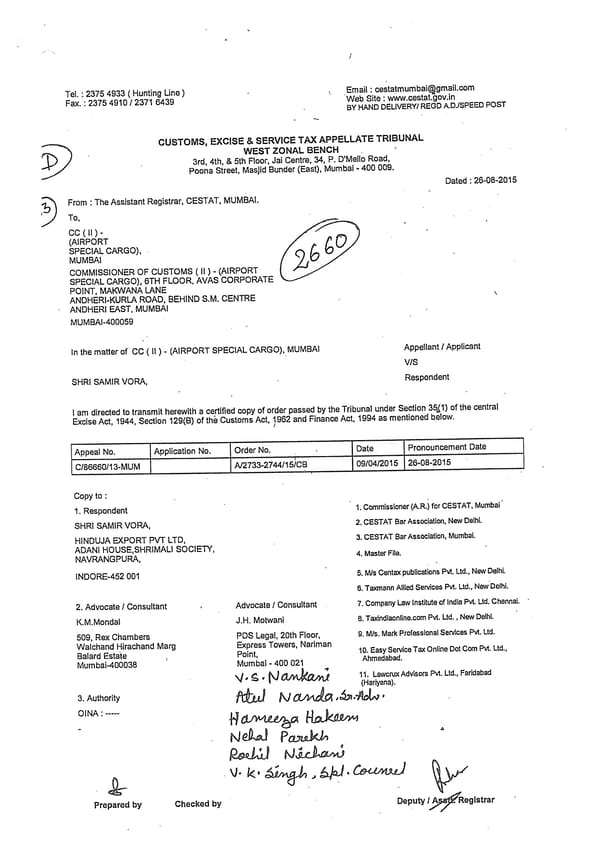

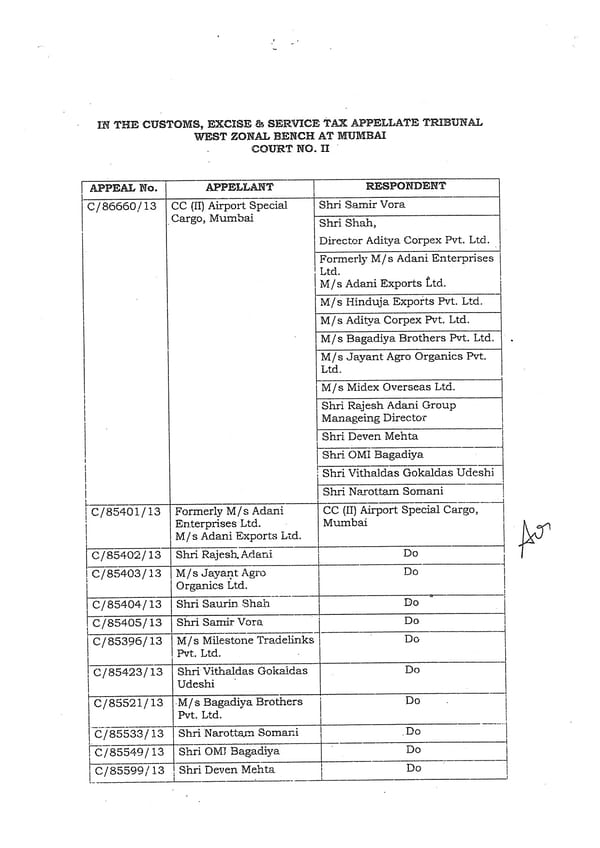

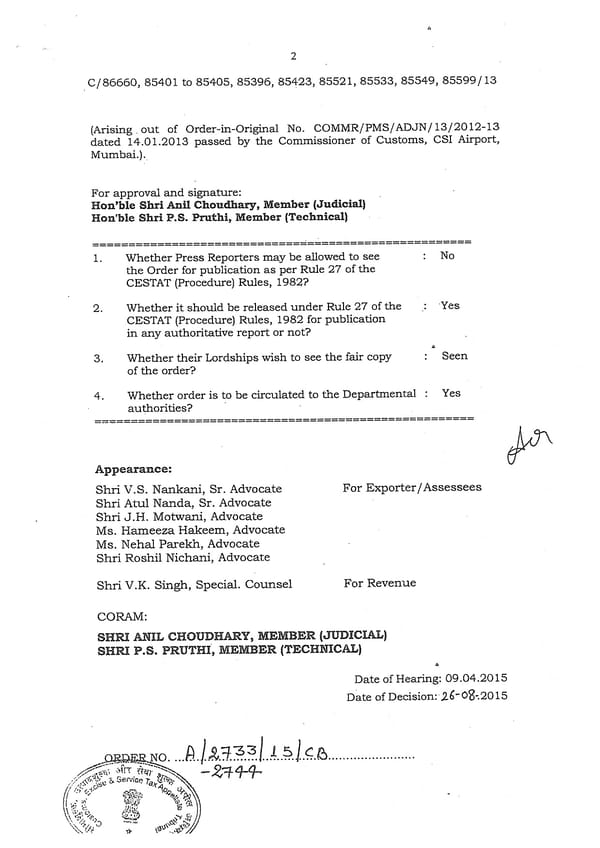

SHORT SELLER ALLE ATIONS – A BRIEF RESPONSE A. Disclosed, discredited and disproven allegations Disclosed, discredited and disproven allegations: Allegations no. 1, 2, 3, 27, 28, 29, 30, 31, 72, 73, 74, 75, 76, 77, 78, 79, 80 present no new findings and only dredge up allegations (in some cases from a decade ago) which have been judicially disproven and have also been disclosed by us to our investors and the regulators. 1/ (Allegation #1) autam Adani’s younger brother, Rajesh Adani, was accused by the Directorate of Revenue Intelligence (DRI) of playing a central role in a diamond trading import/export scheme around 2004-2005. He was subsequently arrested twice over allegations of customs tax evasion, forging import documentation and illegal coal imports. Given his history, why was he subsequently promoted to serve as Managing Director at the Adani Group? 2/ (Allegation #72) Adani has been subject to numerous allegations of fraud by the DRI and other government agencies. In the 2004-2006 diamond scandal investigation, the government alleged that Adani Exports Ltd (renamed Adani Enterprises) and related entities’ exports were x the total exports of all the other 34 firms in the industry group put together. How does Adani explain that sudden surge in trading volume? 3/ (Allegation #73) The diamond export investigation also demonstrated the role played by Vinod Adani and entities in the UAE, Singapore and Hong Kong that were used to facilitate the back-and- forth movement of money and product. How does Adani explain all the trading that took place with entities associated with Vinod Adani? 4/ (Allegation #2) autam Adani’s brother-in-law, Samir Vora, was accused by the DRI of being a ringleader of a diamond trading scam and of repeatedly making false statements to regulators. Given his history, why was he subsequently promoted to Executive Director of the critical Adani Australia division? Common Response - Each of the above matters are closed and dismissed in our favour. Further, these have been disclosed by us in the public domain and all our stakeholders are aware of the same. These have been cited solely in an attempt to further the narrative of lies. In this respect, please see the following: i. Prospectus issued by Adani Ports and Special Economic Zone Limited dated June 5, 2013 (page 181) ii. Offering circular dated July 28, 2016 for the USD 500 million Senior Secured Notes issued by Adani Transmission Limited (page 149) iii. Offering circular dated November 14, 2019 for the USD 500 million Senior Secured Notes issued by Adani Transmission Limited (page 179) iv. Offering circular dated January 26, 2021 for USD 500 million Senior Secured Notes issued by Adani Ports and Special Economic Zone Limited (page 214-215), v. Offering circular dated July 28, 2020 for USD 750 million Senior Secured Notes issued by Adani Ports and Special Economic Zone Limited (page 215), 27

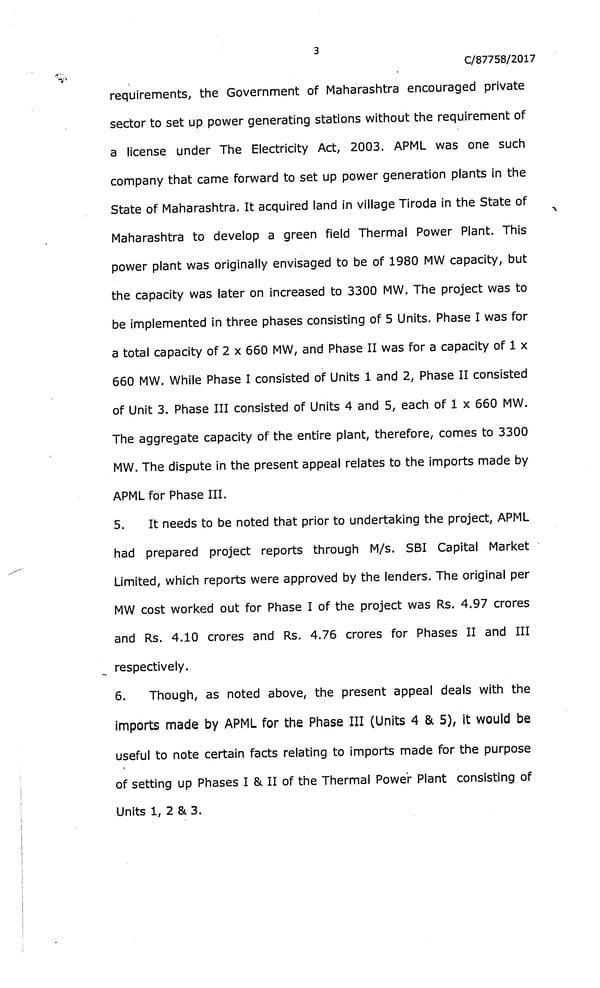

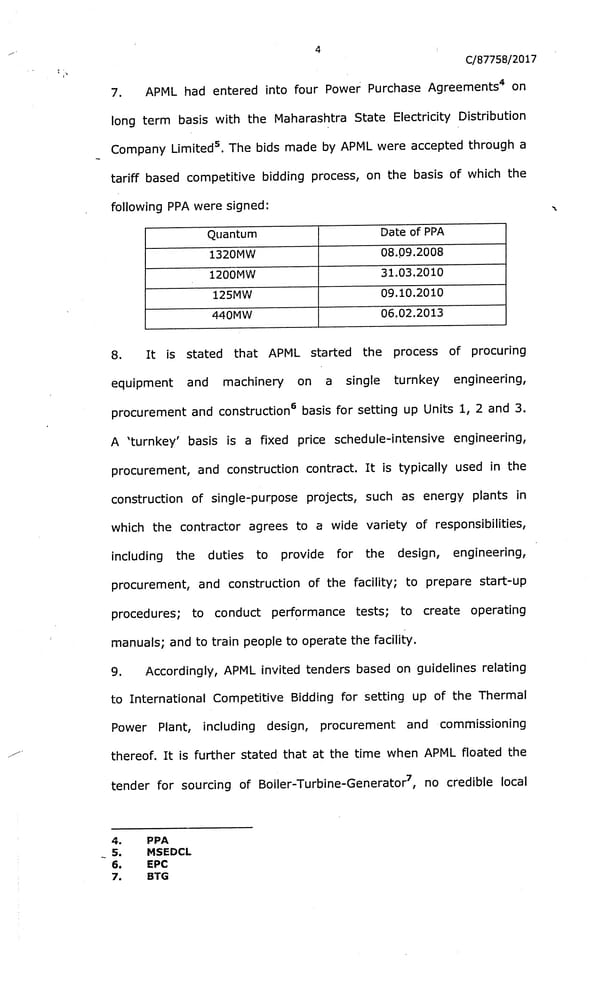

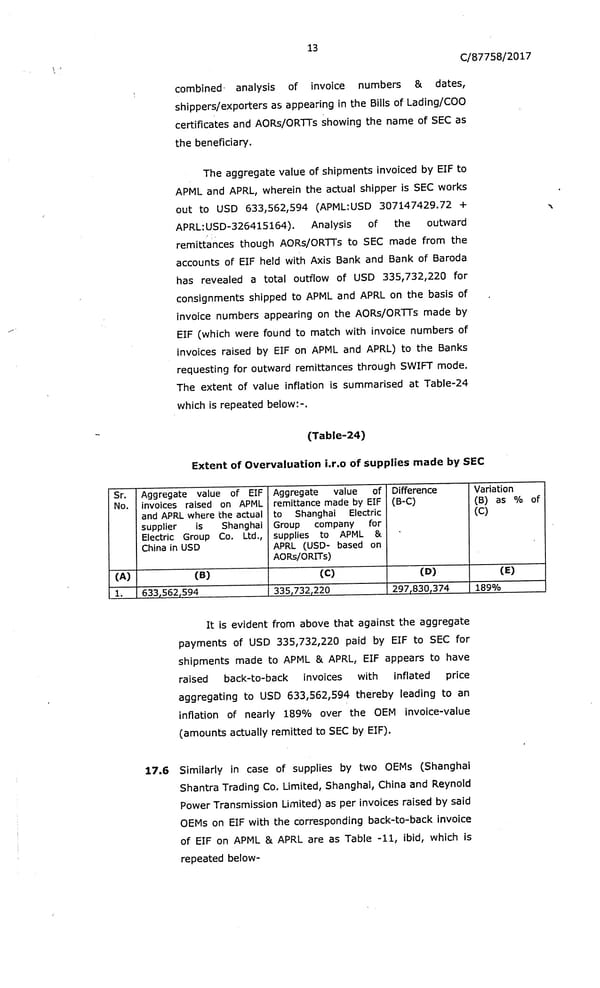

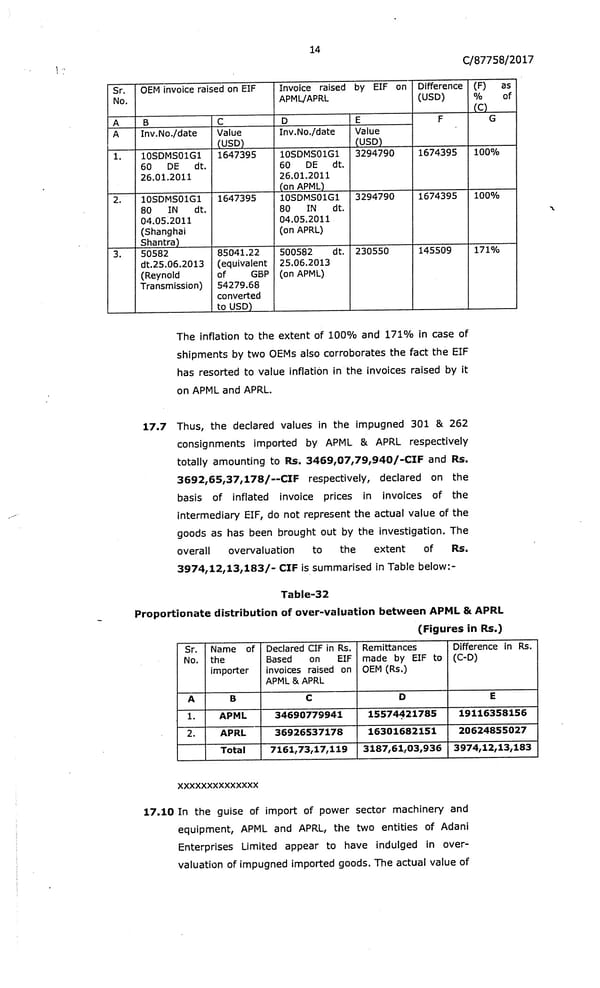

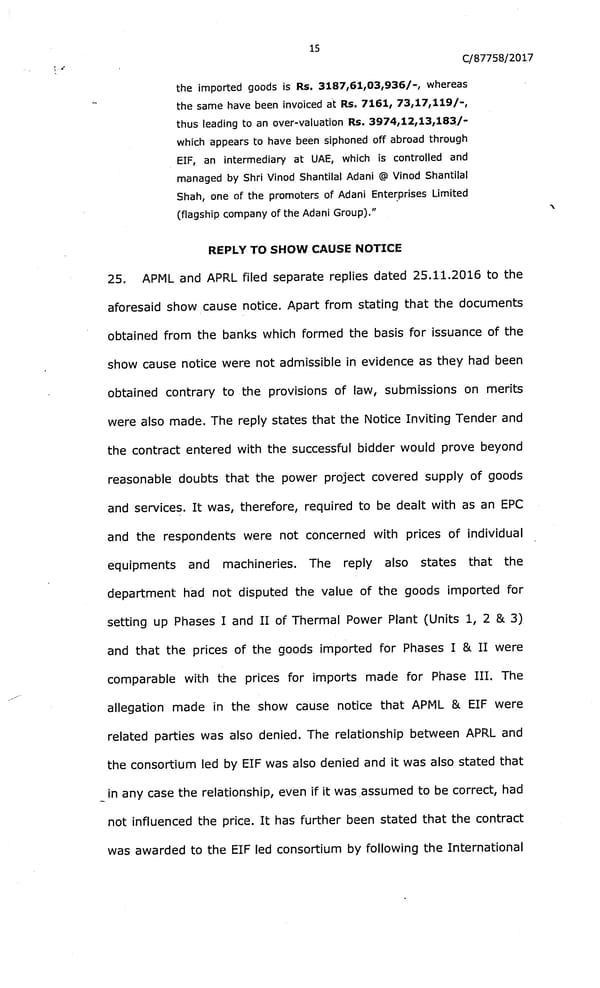

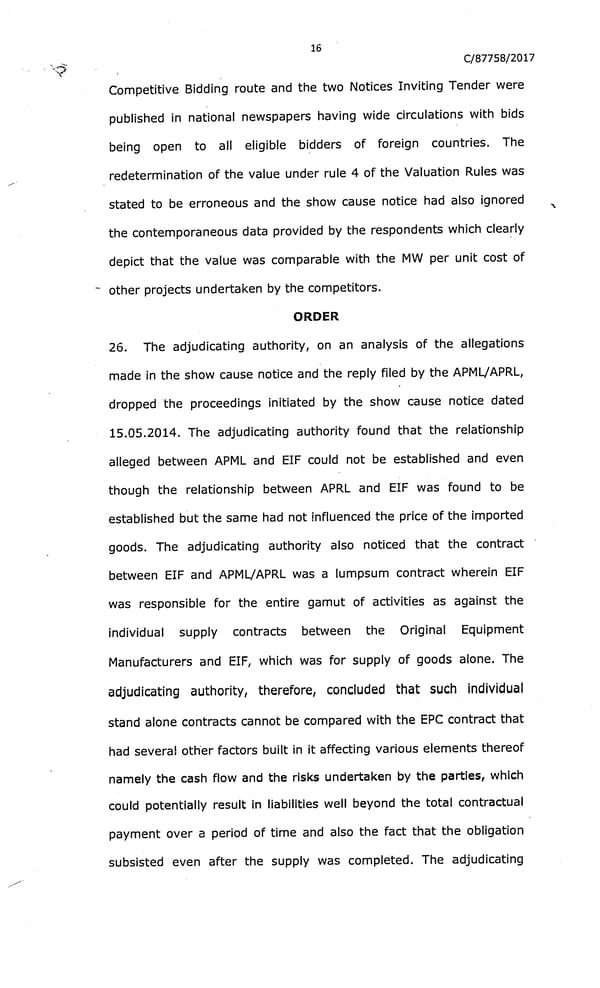

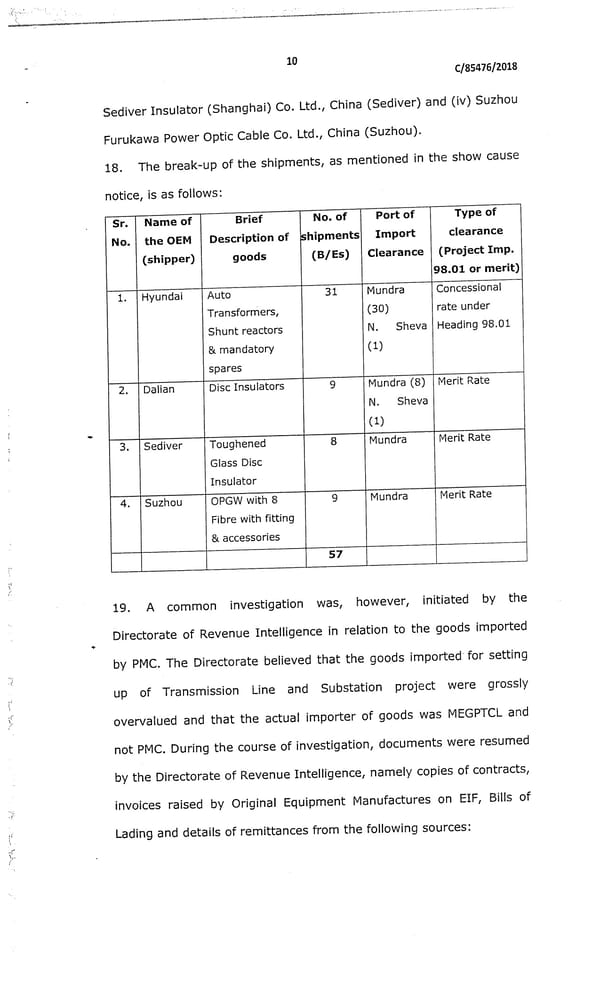

vi. Offering circular dated July 16, 2019 for USD 650 million Senior Secured Notes issued by Adani Ports and Special Economic Zone Limited (page 183), vii. Offering circular dated July 22, 2015 for USD 650 million issued by Adani Ports and Special Economic Zone Limited (page 172), viii. Offering circular dated June 22, 2017 for USD 500 million issued by Adani Ports and Special Economic Zone Limited (page 204), ix. Offering circular dated July 26, 2021 for USD 750 million issued by Adani Ports and Special Economic Zone Limited (page 222 - 223). The relevant excerpts are annexed hereto as Annexure 2. The order of Appellate Tribunal (CESTAT) of August 2015, setting aside all the allegations of DRI and confirming that all exports & imports transactions of diamond were valid & genuine is annexed as Annexure 3. The orders of the Supreme Court of India upholding the order of the Appellate Tribunal (CESTAT) are further annexed as Annexure 4 and Annexure 5. The Hindenburg report clearly omits the fact that the above mentioned order of the Appellate Tribunal (CESTAT) was upheld on further appeal by Supreme Court of India. Lastly, none of these disproven allegations have any relevance in relation to the promotion of Mr. Samir Vora. 5/ (Allegation #3) As part of the DRI investigation into over-invoicing of power imports, Adani claimed that inod Adani was “not at all having any involvement in any Adani roup of companies”, except as shareholder. Despite this claim, a pre-IPO prospectus for Adani Power from 2009 detailed that inod was director of at least 6 Adani roup companies. Were Adani’s original statements about Vinod, made to regulators, false? There were two DRI investigations initiated against us in respect of over-invoicing of power imports. The first DRI investigation (initiated pursuant to show cause notice issued to Maharashtra Eastern Grid Power Transmission Company Limited & others) has been adjudicated before the courts and has been closed and dismissed in our favour and consequently it has been determined that there was no over-invoicing. The second DRI investigation (initiated pursuant to show cause notice issued to Adani Power Maharashtra Limited, Adani Power Rajasthan Ltd. & others) has been decided in our favour both in the lower court as well as in appeal before the CESTAT and consequently it has been determined that there was no over-invoicing. Whilst an appeal in this respect has been preferred and is pending, we strongly believe this will be decided in our favour in line with the decision of the lower court and CESTAT. Each of these investigations are part of disclosures already made by us in the public domain, including the below and our stakeholders are aware of the same for many years. i. Offering circular dated February 5, 2020 for the U.S.$1 bn Senior Secured Notes by Adani Electricity Mumbai Limited (page 34), and ii. Offering circular dated July 13, 2021 for the U.S.$2 bn Global Medium Term Note Programme by Adani Electricity Mumbai Limited (page 53) iii. Offering circular dated July 28, 2016 for the U.S.$500 mn Senior Secured Notes issued by Adani Transmission Limited (page 37 and149) 28

iv. Offering circular dated November 14, 2019 for the U.S.$500 mn Senior Secured Notes issued by Adani Transmission Limited (page 32 and 182) The relevant excerpts from the above documents are annexed hereto in Annexure 2. The relevant orders are appended in Annexure 6 and Annexure 8. Further, the statement made by us in the pre-IPO prospectus in 2009 is absolutely correct. It may also be noted that the over-invoicing allegations for power imports pertains to the period between April 2010 till August 2014, during which period Mr. Vinod Adani was not even a director in any of the relevant Adani entities against whom such investigations were initiated and had no role in their day to day affairs. 6/ (Allegation #27) Our findings indicate that SEBI has investigated and prosecuted more than 70 entities and individuals, including Adani promoters, for manipulating Adani stock between 1999 to 2005. How does Adani respond? There are no ongoing proceedings against the Adani promoters before SEBI in relation to this issue and all past cases before SEBI have been closed. These have also been duly disclosed by us and our stakeholders are already aware of the same. See for instance, p. 51 of the APSEZ Institutional Private Placement Prospectus dated June 2013, the relevant excerpt of which is annexed hereto as Annexure 2. We are neither aware of, nor are we required to be, aware of any proceedings against these other “entities and individuals”, who are not Adani promoters. 7/ (Allegation #28) A SEBI ruling determined that Adani promoters aided and abetted Ketan Parekh in the manipulation of shares of Adani Exports (now Adani Enterprises), showing that 14 Adani private companies transferred shares to entities controlled by Parekh. How does Adani explain this coordinated, systematic stock manipulation in its shares, together with one of India’s most notorious convicted stock fraudsters? 8/ (Allegation #29) In its defense, Adani Group claimed it had dealt with Parekh and his stock manipulation efforts to finance operations at the Mundra port. Does Adani view extraction of capital through stock manipulation as a legitimate method of financing? 9/ (Allegation #30) Individuals close to Ketan Parekh have told us that he continues to work on transactions with his old clients, including Adani. What was and is the full extent of the relationship between Parekh and the Adani roup, including either entity’s relationship with inod Adani? Common Response - The allegation in relation to Ketan Parekh working with Adani companies are incorrect. This matter has been disposed of by SEBI on 17th April 2008 and has also been duly disclosed by us in the public domain. 10/ (Allegation #31) Given that Adani Group promoters pledge shares as collateral for loans, wouldn’t stock manipulation artificially inflate the collateral and borrowing base for such loans, posing a significant risk for the promoters’ counterparties and, by proxy, Adani shareholders who would suffer at the hands of a collateral call or deleveraging via equity sale? 29

Raising financing against shares as collateral is a common practice globally. These loans are given by large reputed financial institutions and banks on the back of thorough credit analysis of the underlying assets in the listed company as well as detailed assessment of liquidity of the company stock pledged as collateral. Further, there is a robust disclosure system in place in India wherein listed companies need to disclose their overall pledge position of shares to stock exchanges from time to time. Consequently, Hindenburg’s narrative of alleged stock manipulation on account of pledge of shares has no basis and stems from ignorance of the securities laws in India. Please refer chart below for promoter pledge position across Adani portfolio listed companies. This clearly shows a significant reduction in the pledge position across all the listed companies. Promoter Gross Pledge position Source: Bombay Stock Exchange (BSE) website. 11/ (Allegation #74) In 2011, the parliamentary Ombudsman for the Karnataka state issued a 466- page report describing Adani as the “anchor point” for a massive INR 600 billion (U.S. $12 billion) scam involving the illegal importation of iron ore, alleging that Adani had bribed all levels of the government in facilitation of the scheme. What is Adani’s response to the investigation and the extensive evidence presented as part of these findings? The proceeding has been closed in July 2017 in our favour. However, in the interest of governance and transparency to all of our stakeholders, the following are details of the matter. The Special Investigation Team (SIT) formed by Karnataka Lokayukta had lodged an FIR against AEL and others. The same was publicly disclosed by AEL vide stock exchange disclosure dated July 30, 2011 (link: https://www.bseindia.com/xml- data/corpfiling/CorpAttachment/2011/7/Adani_Enterprises_Ltd_300711.pdf). The SIT and after a detailed investigation, determined the allegations were false and filed a closure report stating that AEL was not involved in such alleged illegal gratification. This has been accepted by the designated Lokayukta court at Bangalore. 12/ (Allegation #75) In 2014, the DRI once again accused Adani of using intermediary UAE-based shell entities controlled by Vinod Adani to siphon funds, in this case through the over-invoicing of 30

power equipment. Did Adani invoice the power equipment purchases to UAE-based entities such as Electrogen Infra FZE? If so, why? 13/ (Allegation #76) Was there a markup from the original purchase price for the equipment? What services did the Vinod Adani-associated entities provide that would have justified a markup? 14/ (Allegation #77) The same DRI investigation found that inod Adani’s intermediary entity sent ~$900 million to a privately owned Adani entity in Mauritius. What is the explanation for these transactions? 15/ (Allegation #78) Where did the money from these transactions go after it was sent to a private Adani entity in Mauritius? 16/ (Allegation #79) The DRI investigation also documented many other transactions through the Vinod Adani intermediary entity, which were not probed further by investigators. What is Adani’s explanation for these other transactions? There were two DRI investigations initiated against us in respect of over-invoicing of power equipment. The first DRI investigation (initiated pursuant to show cause notice issued to Maharashtra Eastern Grid Power Transmission Company Limited & others) has been adjudicated before the courts and has been closed and dismissed in our favour. The second DRI investigation (initiated pursuant to show cause notice issued to Adani Power Maharashtra Limited, Adani Power Rajasthan Ltd. & others) has been decided in our favour both by the DRI (the same authority who issued the show cause notice) as well as in appeal before the CESTAT. It has been held by CESTAT that all the imports were genuine and being undertaken at arm’s length and concluded that the value declared is correct and the value is not required to be redetermined. Whilst another appeal in this respect has been preferred in November 2022 and is pending, we strongly believe this will be decided in our favour in line with the decision of CESTAT. Each of these investigations are part of disclosures already made by us in the public domain, including the below and our stakeholders are aware of the same for many years. i. Offering circular dated February 5, 2020 for the U.S.$1 bn Senior Secured Notes by Adani Electricity Mumbai Limited (page 34), and ii. Offering circular dated July 13, 2021 for the U.S.$2 bn Global Medium Term Note Programme by Adani Electricity Mumbai Limited (page 53) iii. Offering circular dated July 28, 2016 for the U.S.$500 mn Senior Secured Notes issued by Adani Transmission Limited (page 37 and149) iv. Offering circular dated November 14, 2019 for the U.S.$500 mn Senior Secured Notes issued by Adani Transmission Limited (page 32 and 182) The relevant excerpts from the above documents are annexed hereto in Annexure 2. The relevant orders are appended in Annexure 6 and Annexure 8. 17/ (Allegation #80) In yet another scandal, Adani was accused of over-valuing coal imports through shell entities in Dubai, the UAE, Singapore, and the BVI. Did Adani transact with entities in these jurisdictions? If so, which ones and why? DRI, Mumbai initiated an investigation against around 40 importers (40 Companies) of coal for import made during Oct. 2010 to Mar. 2016 and sought for various documents including Invoice of 31

Supplier, Country of Origin Certificate (Form A1), Bill of Entry, Bill of Lading etc. In compliance with the DRI directions, we have already submitted the necessary documents to the regulator. No show cause notice has been issued to us till date. B. Baseless allegations around transactions which are in fact, compliant with law, fully disclosed and on proper commercial terms Baseless allegations around transactions which are in fact, compliant with law, fully disclosed and on proper commercial terms: Allegation no. 9, 15, 19, 24, 25, 32, 33, 35, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, 51, 53, 54, 55, 56, 57, 58, 59, 60, 61, 81, 82 & 83 are again a selective regurgitation of disclosures from the financial statements of Adani entities to paint a biased picture. These disclosures have already been approved by third parties who are qualified and competent to review these (rather than an unknown overseas shortseller) and are in line with applicable accounting standards and applicable law. The Indian legislations (Companies Act, Listing Regulations, Accounting Standards etc) have one of the most robust and well-defined framework to identify and determine “related parties”. Adani roup’s Indian entities follow and comply with these legislations at all times. Further, all related party transactions are at arm’s length, properly disclosed and reviewed/audited by statutory independent auditors, of relevant entities periodically. In a similar manner, overseas entities, follow the law of land, of their respective jurisdiction. The assumption that the entities, as stated in the Report, are related to Adani listed entities, is imaginary, vague and unsubstantiated and flows only from a lack of understanding by Hindenburg of the Indian laws, regulations and accounting standards. The Audit Committee of each of the listed companies that reviews and approves these related party transactions is composed of 100% of Independent Directors and chaired by Independent Director. The Statutory Auditors are appointed only upon recommendation by the Audit Committee to the Board of Directors. Adani Portfolio companies follow a stated policy of having global Big 6 or regional leaders as Statutory Auditors. Further Adani Portfolio also has a policy to conduct an independent review of disclosure and notes by one of the Big 6 across all portfolio companies and the last review carried out for FY 20 and FY 21 was undertaken by Grant Thornton. Indian regulations have high standards of corporate governance which we have consistently complied with. Hindenburg Research does not appear to have any understanding on matters of Indian law or accounting standards and yet makes claims of entities being undisclosed “related parties” with no understanding of what constitutes a related party. In several instances, the report makes unsubstantiated statements of “close relationships” and “conflicts of interest” as “related party”. Any mere close or business relationship of any promoter entity or their relatives does not make a transaction a related party transaction. 18/ (Allegation #35) We found at least 38 Mauritius-based entities associated with Vinod Adani and Subir Mittra (the head of the Adani private family office). We also found Vinod Adani associated entities in other tax haven jurisdictions like Cyprus, the UAE, Singapore, and various Caribbean islands. Several of these entities have transacted with Adani entities without disclosing the related party nature of the dealings, seemingly in violation of the law, as evidenced throughout our report. What is the explanation for this? 32

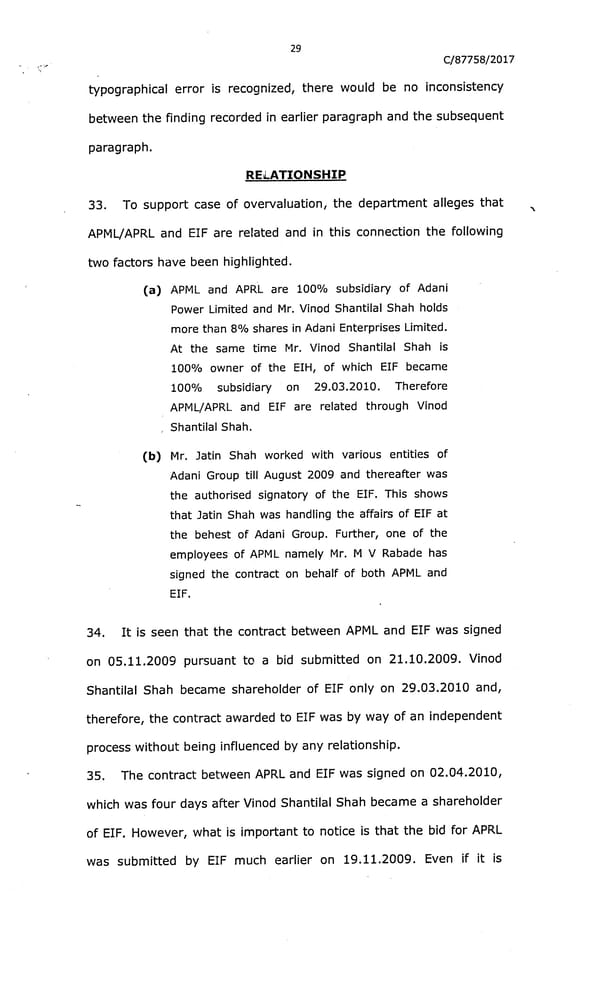

All transactions entered into by us with entities who qualify as ‘related parties’ under Indian laws and accounting standards have been duly disclosed by us. Further these have been carried out on arm’s length terms in accordance with applicable laws. Further, these are also disclosed by us, are publicly available to all regulators and our stakeholders, and have been duly verified and audited by independent third parties who are competent and have the required expertise in this respect. As stated above, Adani Portfolio companies follow a stated policy of having global big 6 or regional leaders as Statutory Auditors. 19/ (Allegation #44) We have identified a series of transactions from 2013-2015 whereby assets were transferred from a subsidiary of listed Adani Enterprises to a private Singaporean entity controlled by Vinod Adani, without disclosure of the related party nature of these deals. What is the explanation for these transactions and the lack of disclosure? 20/ (Allegation #45) The private Singaporean entity controlled by Vinod Adani almost immediately wrote down the value of the transferred assets. Were those still held on the books of Adani Enterprises, it likely would have resulted in an impairment and significant decline in reported net income. What is the explanation for why these assets were transferred to a private undisclosed related party before being written down? Common Response - The transactions relate to transfer of the cost to the specific project entity which was incorporated for rail businesses (Carmichael Rail Network Trust incorporated on 17th September 2014). These transactions have been carried out in compliance with applicable law and on arm’s length terms. The amounts transferred included: (i) Exploration and Evaluation Assets (i.e. Capital works in progress (‘C I ’)); and (ii) Amounts already expensed to profit and loss account and an arms length management fee charged by Adani Mining Pty Ltd (a step-down subsidiary of Adani Enterprises) These transactions were fully disclosed in the financial statements Adani Mining Pty Ltd. (AMPL), as below. Source: Page 14 of the Financial Statement of AMPL for FY15 showing the part-transfer of Exploration and Evaluation Assets. Source: Page 13 of the Financial Statement of AMPL for FY15 showing the reversal of cost which was expensed in P&L account in earlier years and other income on account of management fee 33

Treatment of these amounts in the acquiring entity The transaction represented a transfer of project specific amounts from CWIP & P&L, and to keep the treatment of the amount consistent with how it was originally treated in the financials of AMPL. The amount of A$92,928,540 (which represented the transfer of Exploration and Evaluation Assets) was recorded as CWIP and the balance amount taken to the P&L account through an expense of A$23,255,069 as general and administration expenses. The amount of A$23,255,069 presented as day one write off of CWIP were already part of the expenses of AMPL in the previous years and current year in which the transfer occurred and hence it was not an immediate write off of acquired assets but an accounting transfer of an amount from CWIP to P&L account as required and consistent with accounting principles. Source: Page 13 of the Financial Statement of Carmichael rail network trust for FY15 34

21/ (Allegation #40) A Vinod Adani-controlled Mauritius entity now called Krunal Trade & Investment lent INR 11.71 billion (U.S. ~$253 million) to a private Adani entity without disclosure of it being a related party loan. How does Adani explain this? 22/ (Allegation #42) A Vinod Adani-controlled Cyprus entity called Vakoder Investments has no signs of employees, no substantive online presence, and no clear operations. It had an investment of U.S. ~$85 million in an Adani private entity without disclosure that it was a related party. How does Adani explain this? 23/ (Allegation #43) What was the source of the Vakoder funds? 24/ (Allegation #46) We found that a “silver bar” merchant based at a residence with no website and no obvious signs of operations, run by a current and former Adani director, lent INR 15 billion (U.S. $202 million) to private Adani Infra with no disclosure of it being a related party transaction. What is the explanation for the lack of required disclosure? 25/ (Allegation #48) Gardenia Trade and Investments is a Mauritius-based entity with no website, no employees on LinkedIn, no social media presence, and no apparent web presence. One of its directors is Subir Mittra, the head of the Adani private family office. The entity lent INR 51.4 billion (U.S. $692.5 million) to private Adani Infra with no disclosure of it being a related party loan. What is the explanation for the lack of required disclosure? 26/ (Allegation #47) What was the purpose of the loan, and what was the original source of the “silver bar” merchant’s funds? 27/ (Allegation #49) What was the purpose of the loan, and what was the original source of the Gardenia Trade and Investments funds? 28/ (Allegation #50) Milestone Tradelinks, another claimed silver and gold merchant also run by a longstanding employee of the Adani Group and a former director of Adani companies, invested INR 7.5 billion (U.S. $101 million) into Adani Infra. Once again there was no disclosure of it being a related party loan. What is the explanation for the lack of required disclosure? 29/ (Allegation #51) What was the purpose of the loan, and what was the original source of the Milestone Tradelinks funds? Common Response - The above cited transactions with Krunal Trade & Investment, Vakoder, Rehvar Infrastructure, Milestone Tradelink, ardenia Trade and Investment and the ‘private Adani entities’ are not ‘related party transactions’ under laws of Indian or accounting standards. Consequently, we are neither aware nor required to be aware of their ‘source of funds’. All transactions cited above between the Adani listed entities and the “private Adani entities”, i.e., Adani Estates Private Limited, Sunbourne Developers Private Limited are related party transactions, which have been undertaken on arm’s length terms and in compliance with applicable Indian laws and standard, and have also been fully disclosed as related party transactions. 30/ (Allegation #41) A Vinod Adani-controlled UAE entity called Emerging Market Investment DMCC lists no employees on LinkedIn, has no substantive online presence, has announced no clients or 35

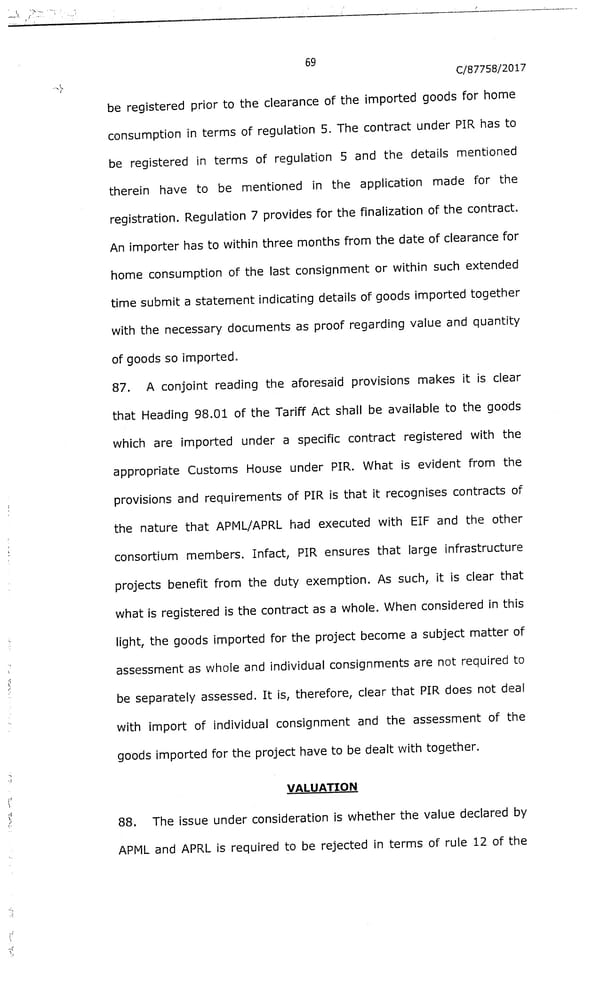

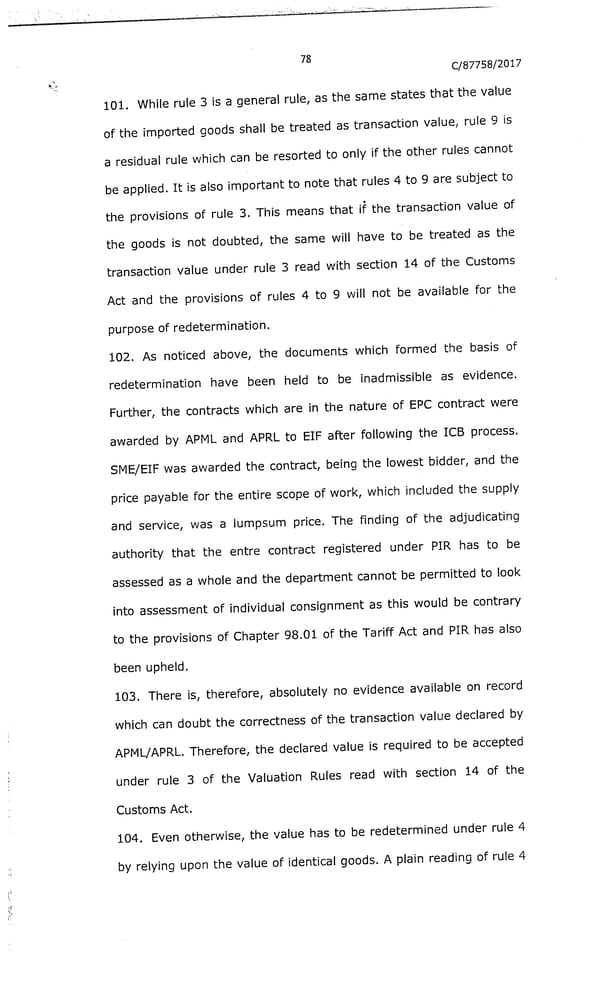

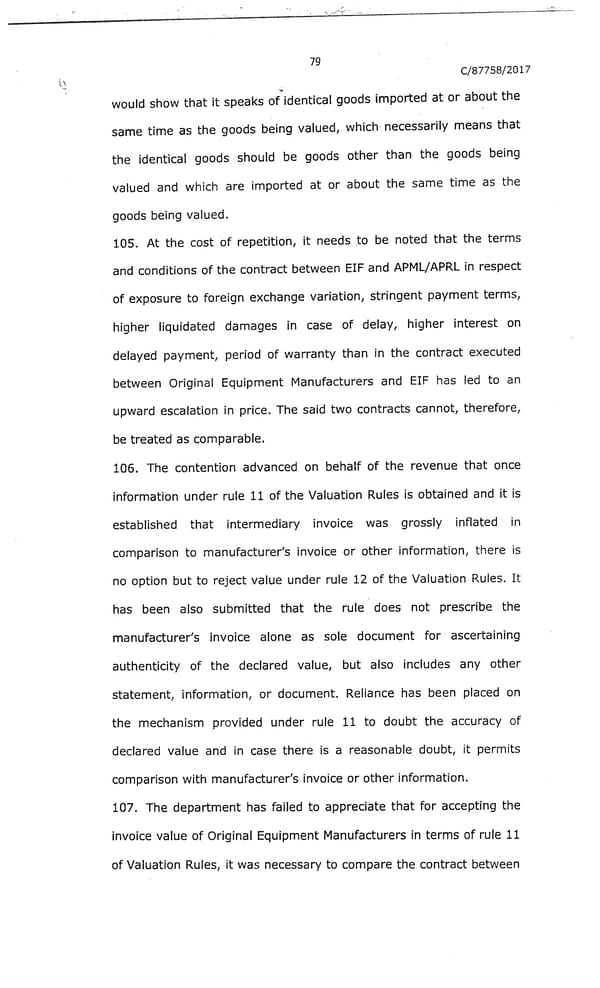

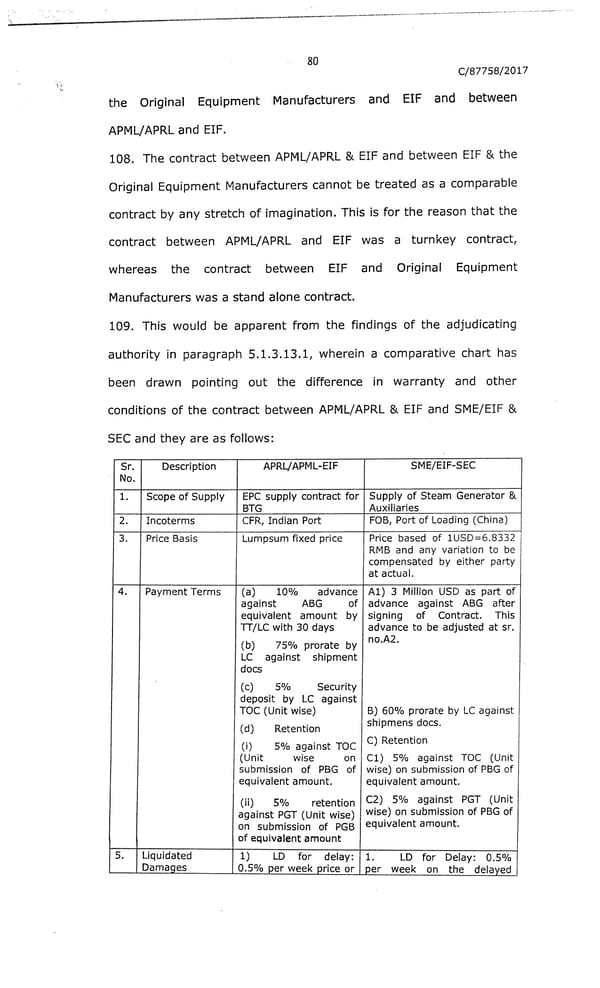

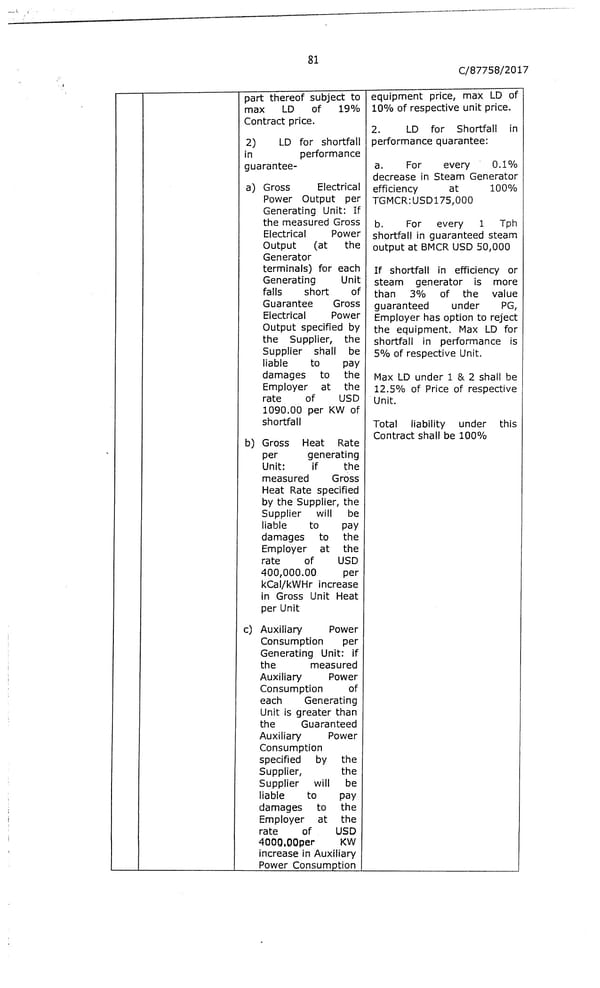

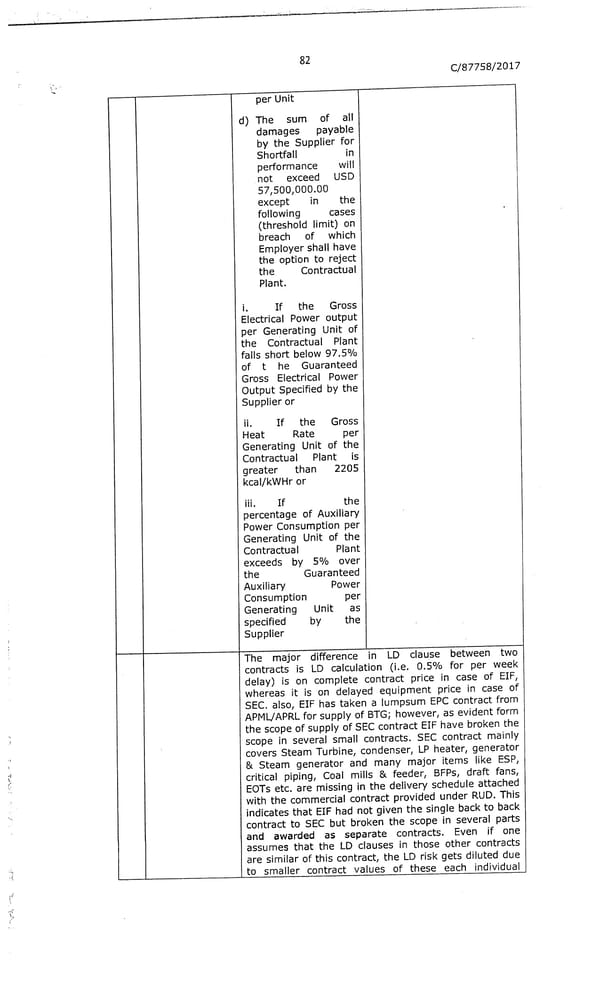

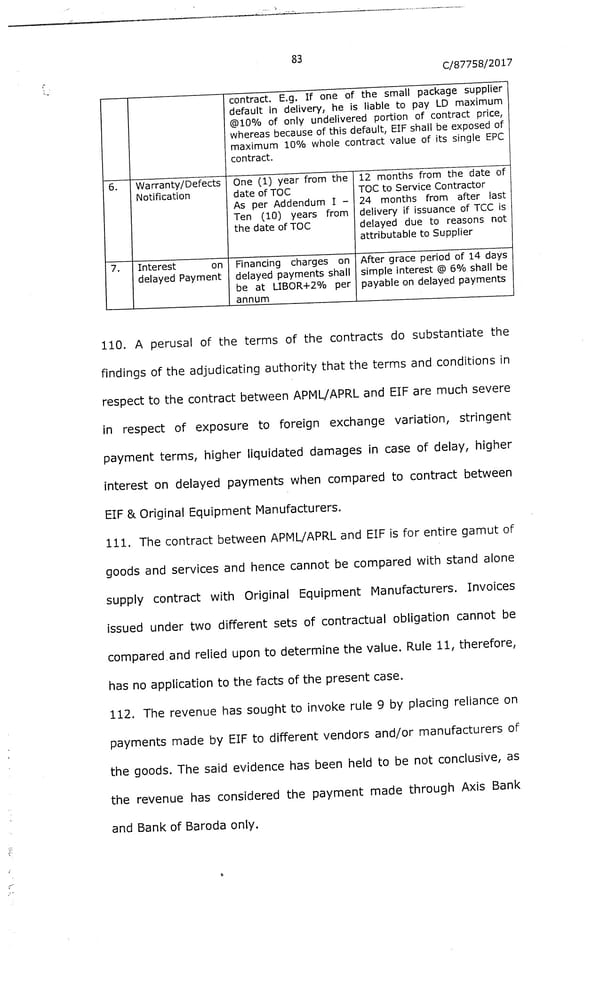

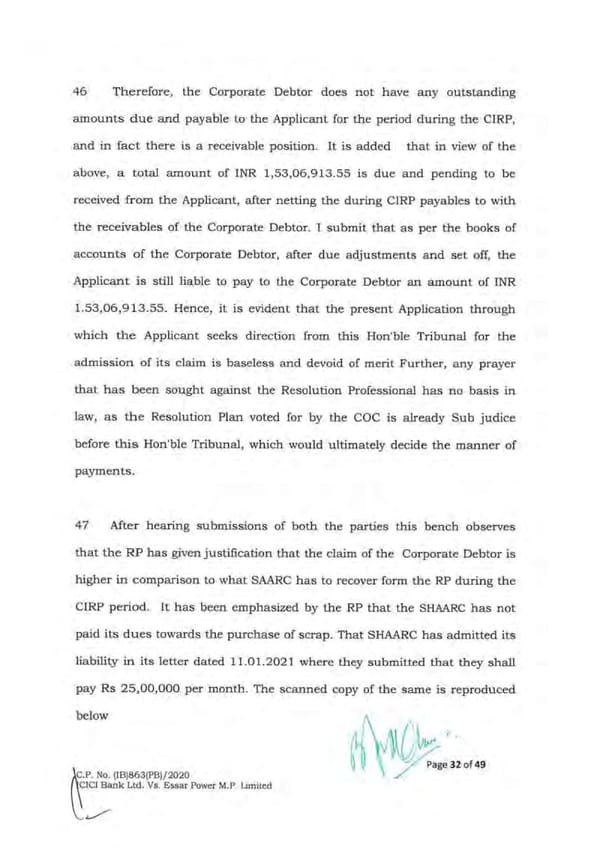

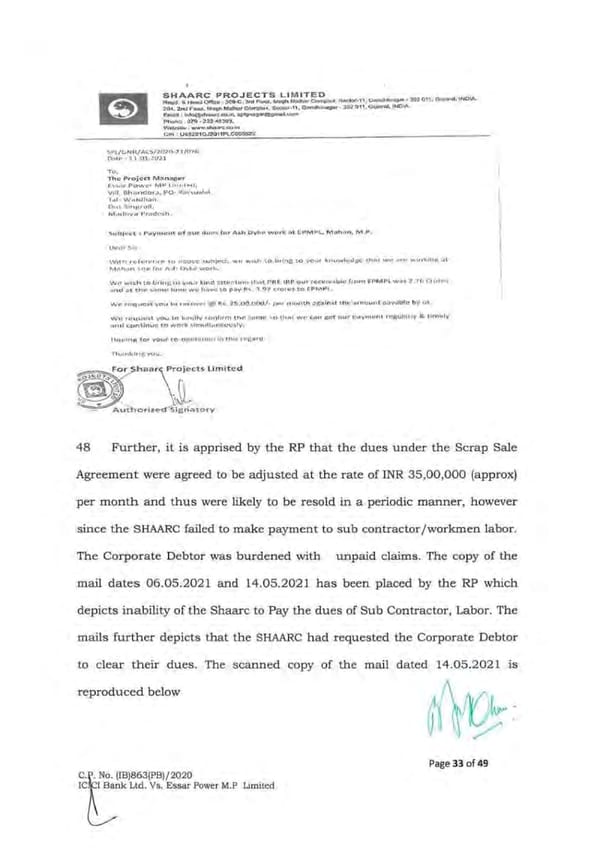

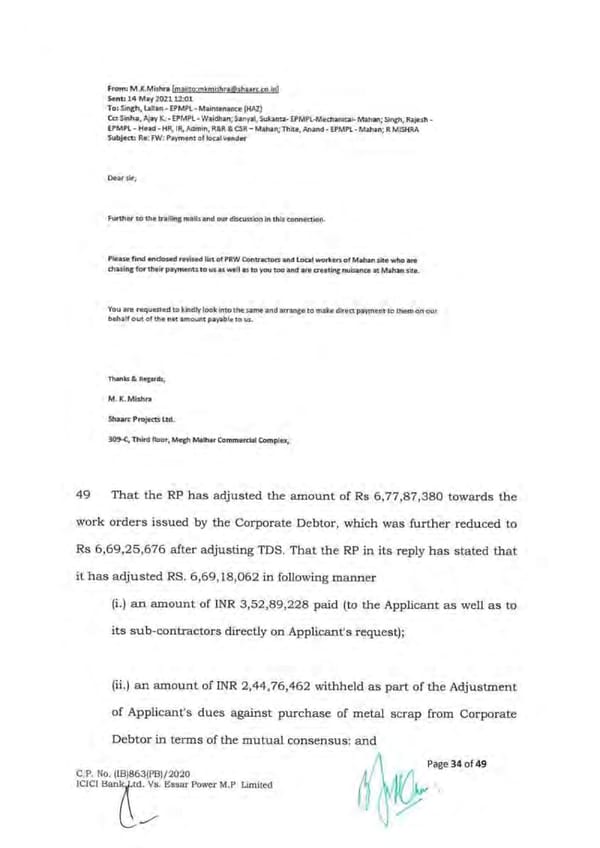

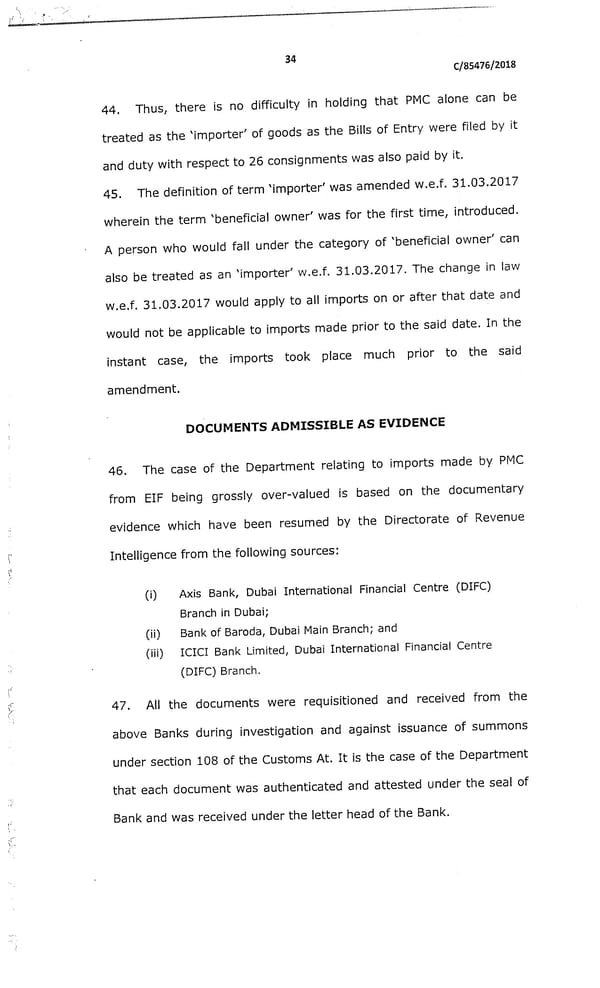

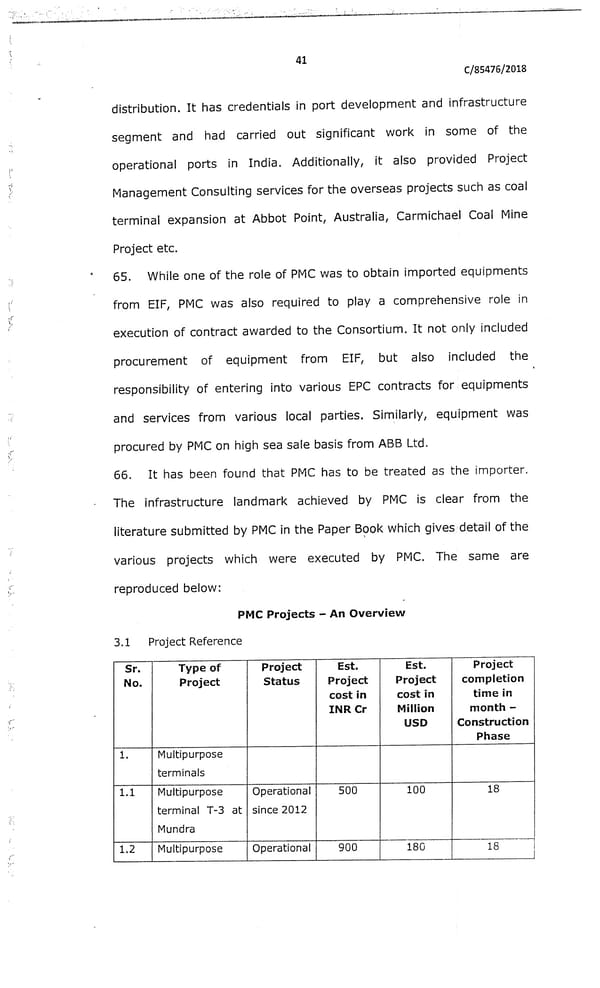

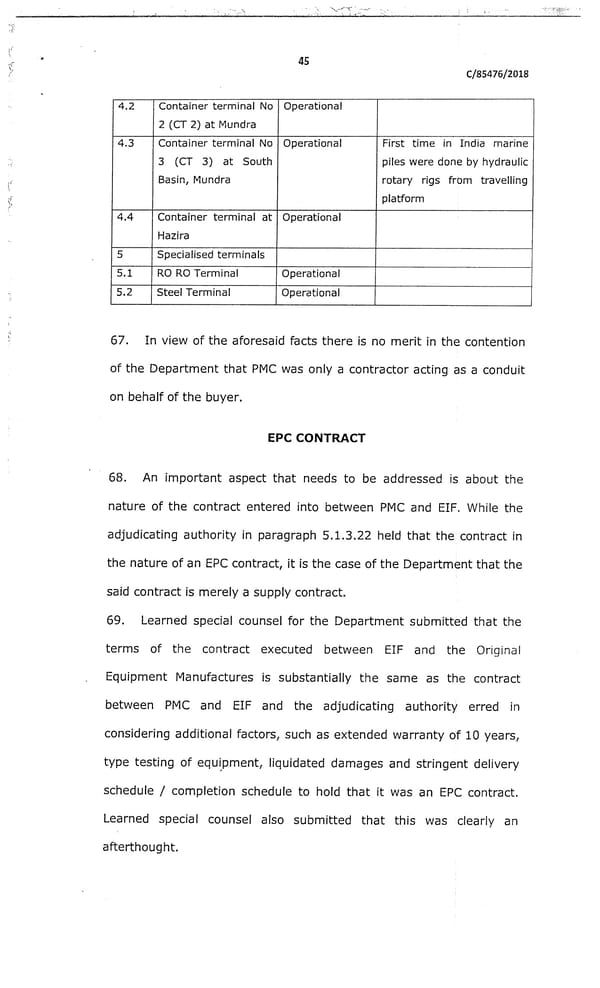

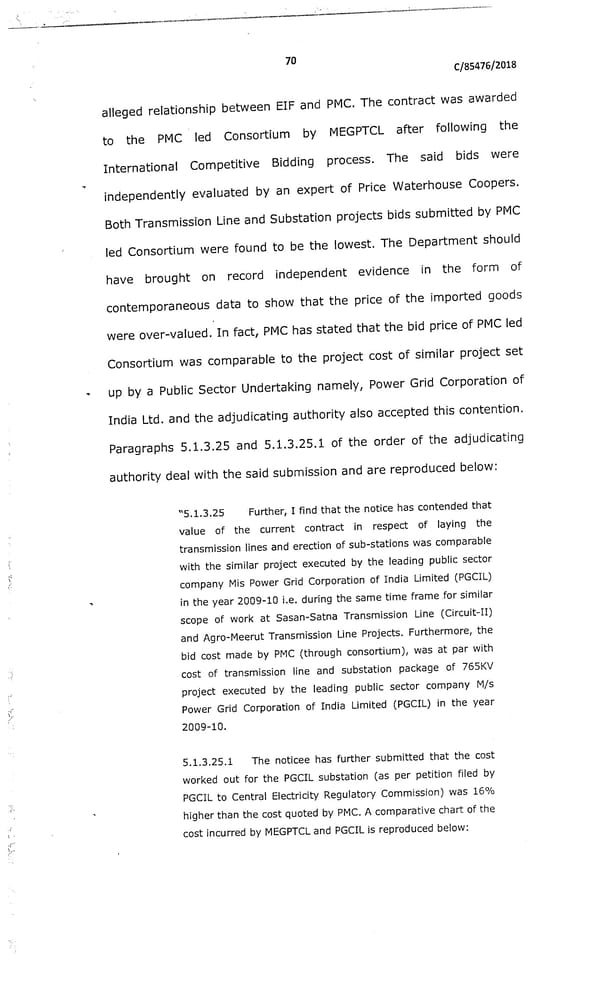

deals, and is based out of an apartment in the UAE. It lent U.S. $1 billion to an Adani Power subsidiary. What was the source of the Emerging Market Investment DMCC funds? This allegation is clearly incorrect and is due to a lack of understanding of the Indian debt restructuring regulations. As part of the debt resolution plan of Mahan Energen Limited (earlier named as Essar Mahan Limited), duly approved by the NCLT under the Indian Bankruptcy Code, Emerging Market Investment DMCC (an affiliate of Adani Power Limited, the successful bidder for this asset) acquired the unsustainable debt from the erstwhile lenders of Mahan Energen Limited for a consideration of USD 100. Emerging Market Investment DMCC has not ‘lent’ U.S. $1 billion to Mahan Energen, but has acquired this debt by paying USD 100 as part of the NCLT approved resolution plan. The order of the National Company Law Tribunal is annexed as Annexure 7. In any event, there is no restriction on Adani listed entities/ their subsidiaries to avail loans from promoter entities from time to time for their business purposes. All such loans are availed in compliance with relevant laws and are suitably disclosed as required under the laws and accounting standard. 31/(Allegation #58) In FY20, AdiCorp Enterprises only generated INR 6.9 million (U.S. $97,000) in net profit. That same year, 4 Adani Group companies entities lent it U.S. ~$87.4 million, or more than 900 years of AdiCorp net income. These loans seemed to make little financial sense. What was the underwriting process and business rationale that went into making these loans? 32/ (Allegation #59) AdiCorp almost immediately re-lent 98% of those loans to listed Adani Power. Was AdiCorp simply used as a conduit to surreptitiously move funds into Adani Power from other Adani Group entities and side-step related party norms? Common Response - AdiCorp is not a related party, and transactions with AdiCorp are not ‘related party transactions’ under laws of Indian or accounting standards and these have been undertaken in compliance with applicable law. 33/ (Allegation #61) Listed company Adani Enterprises paid U.S. $100 million to a company, ultimately held by private trust of the Adani family in the British Virgin Islands (BVI), a notorious Caribbean tax haven, with the claimed rationale being to pay a security deposit to use an Australian coal terminal. Why did the listed company need to pay such lucrative fees to Adani’s private interests? Hindenburg seems to suggest, that simply because two parties are related, transactions between them cannot be for arm’s length consideration. It has clearly been disclosed by us that North Queensland Export Terminal Pty Ltd (formerly known as Adani Abbot Point Terminal Pty Ltd) (“N XT”) is a related party of Adani Mining Pty Ltd (a stepdown subsidiary of Adani Enterprises Limited), and transactions between them are related party transactions. Hindenburg has also conveniently failed to mention that NQXT is a multi-user terminal and Adani Mining Pty Ltd is one of more than nine major long-term customers of NQXT. As part of any long term take or pay contract for accessing the port infrastructure such as NQXT, users typically provide credit support in order to secure their obligations. In this case, as fully disclosed, Adani Mining Pty Ltd paid N XT a ‘security deposit’ to secure its obligations under the long term take or pay contract. The amount was neither ‘charged’ nor was a ‘fee’ as incorrectly alleged in the report. 36