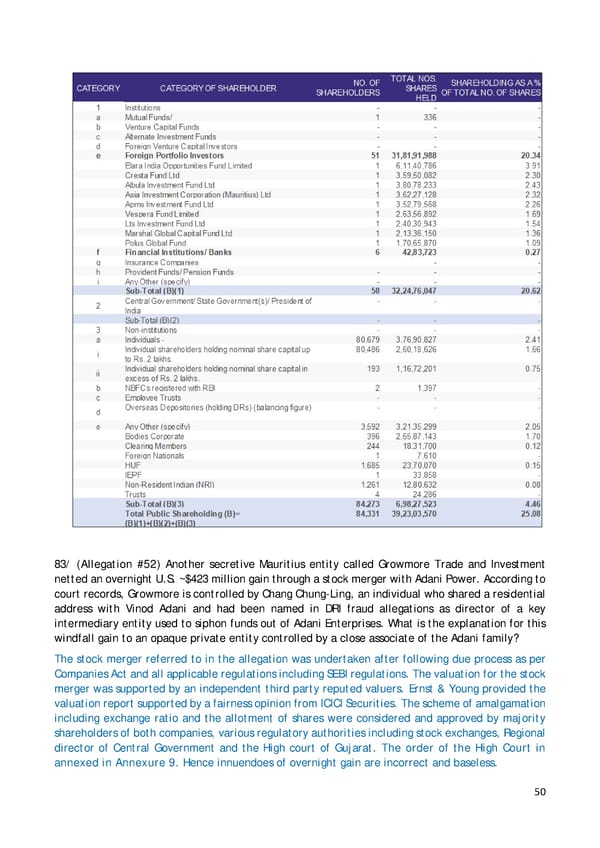

83/ (Allegation #52) Another secretive Mauritius entity called Growmore Trade and Investment netted an overnight U.S. ~$423 million gain through a stock merger with Adani Power. According to court records, Growmore is controlled by Chang Chung-Ling, an individual who shared a residential address with Vinod Adani and had been named in DRI fraud allegations as director of a key intermediary entity used to siphon funds out of Adani Enterprises. What is the explanation for this windfall gain to an opaque private entity controlled by a close associate of the Adani family? The stock merger referred to in the allegation was undertaken after following due process as per Companies Act and all applicable regulations including SEBI regulations. The valuation for the stock merger was supported by an independent third party reputed valuers. Ernst & Young provided the valuation report supported by a fairness opinion from ICICI Securities. The scheme of amalgamation including exchange ratio and the allotment of shares were considered and approved by majority shareholders of both companies, various regulatory authorities including stock exchanges, Regional director of Central Government and the High court of Gujarat. The order of the High Court in annexed in Annexure 9. Hence innuendoes of overnight gain are incorrect and baseless. 50

Adani Response Page 49 Page 51

Adani Response Page 49 Page 51