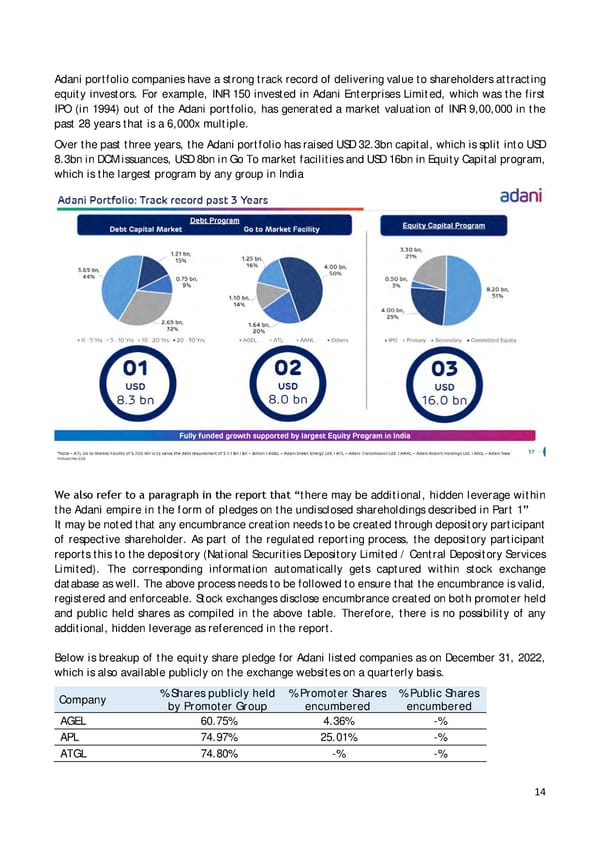

Adani portfolio companies have a strong track record of delivering value to shareholders attracting equity investors. For example, INR 150 invested in Adani Enterprises Limited, which was the first IPO (in 1994) out of the Adani portfolio, has generated a market valuation of INR 9,00,000 in the past 28 years that is a 6,000x multiple. Over the past three years, the Adani portfolio has raised USD 32.3bn capital, which is split into USD 8.3bn in DCM issuances, USD 8bn in Go To market facilities and USD 16bn in Equity Capital program, which is the largest program by any group in India We also refer to a paragraph in the report that “there may be additional, hidden leverage within the Adani empire in the form of pledges on the undisclosed shareholdings described in Part 1” It may be noted that any encumbrance creation needs to be created through depository participant of respective shareholder. As part of the regulated reporting process, the depository participant reports this to the depository (National Securities Depository Limited / Central Depository Services Limited). The corresponding information automatically gets captured within stock exchange database as well. The above process needs to be followed to ensure that the encumbrance is valid, registered and enforceable. Stock exchanges disclose encumbrance created on both promoter held and public held shares as compiled in the above table. Therefore, there is no possibility of any additional, hidden leverage as referenced in the report. Below is breakup of the equity share pledge for Adani listed companies as on December 31, 2022, which is also available publicly on the exchange websites on a quarterly basis. Company % Shares publicly held % Promoter Shares % Public Shares by Promoter Group encumbered encumbered AGEL 60.75% 4.36% -% APL 74.97% 25.01% -% ATGL 74.80% -% -% 14

Adani Response Page 13 Page 15

Adani Response Page 13 Page 15